Note:

ACT - Finance - Banks (Section 5.3.5.1 to Appendix)

Please Read Before Providing Comments

Thank you for taking the time to review the ACT Finance Banks methodology.

Instructions: Reviewing the ACT Finance Methodology

If you want to provide comments – click on the new comment button located on the right side.

You will be asked to register by clicking on the yellow register button.

If you are already registered on ScribeHub, please sign in (top right corner) before accessing the document and commenting.

Registering

If you are not already registered to ScribeHub, you will be asked to register on the platform - providing your email address, name and creating a password. You will then be sent a confirmation email. Click on the Confirm my account link in the email and you will be redirected to the login screen for ScribeHub. Enter you email and password and you will then have access to the document.

Please note that your name and email address will be used by the ACT team to record the list of people providing comments during this public consultation. Remember the email and password you use to register as this information will always be required to log in to ScribeHub.

Commenting

Once on ScribeHub, please use the comment button

beside each section header to input your feedback. Pressing on the + sign will open a dialog box where you can input the title of your comment, the related section of the document, and your comment. Keep in mind that comments are publicly visible. You can also reply directly to a comment already posted.

The methodology will be proofread before publication, so no need to flag minor editing issues.

Timeline

Please provide your feedback by February 10, 2023

Contact

If you encounter any problems at all with the ScribeHub platform please contact Patrick Hardy.

You can also download the ACT Framework from the ACT website for more context.

Thank you!

Thank you once again for providing valuable feedback, we look forward to reviewing it

5. Construction of Data Infrastructure

5.3 Performance Indicators

5.3.5 Module 5: Management

The indicator assesses the incorporation of climate strategy into its governance structure, remuneration policies and risk management.

5.3.5.1 LEN 5.1 Oversight of climate change issues

| Description & Requirements | LEN 5.1 Oversight of climate change issues |

|---|---|

| Short description of indicator | The financial institution discloses that responsibility for climate change mitigation within the financial institution lies at the highest level of decision-making within the financial institution structure. |

| Data requirements |

The relevant data for this indicator are:

CDP Questionnaire mapping to this indicator:

External sources of data may also be used for the analysis of this indicator. |

| How the assessment will be done |

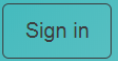

The benchmark case is that climate change is managed within the highest decision-making structure within the financial institution. The position at which climate change is managed within the financial institution structure is determined from the financial institution data submission and accompanying evidence. If the corporate structure does not match the structure of the maturity matrix, the analyst should assign a score based on the financial institution’s specific hierarchy (i.e., if responsibility for climate change mitigation lies at the highest level of decision-making within the organization, award “Low-carbon aligned”. If responsibility lies one level below the highest level, award “Next practice”, etc.). The maturity matrix used for the assessment is the following:

Further guidance for each level of seniority is given below: Level 1

Level 2

Level 3

Level 4

|

| Rationale | LEN 5.1 Oversight of climate change issues |

| Rationale of the indicator |

Successful change within financial institution, such as the transition to a low-carbon economy, requires strategic oversight and buy-in from the highest levels of decision-making within the financial institution. Evidence of how climate change is addressed within the top decision-making structures is a proxy for how seriously the company takes climate change, and how well integrated it is at a strategic level. High-level ownership also increases the likelihood of effective action to address low-carbon transition. Changes in strategic direction are necessarily future-oriented, which fits with this principle of the ACT initiative. Managing oversight of climate change is considered as a good practice. |

5.3.5.2 LEN 5.2 Climate change oversight capability

| Description & Requirements | LEN 5.2 Climate change oversight capability |

|---|---|

| Short description of indicator |

Financial institution board or executive management has expertise on the science and economics of climate change, including an understanding of policy, technology drivers that can disrupt current business. This expertise is used by the individual or committee to inform high-level decision-making within the financial institution. The employees, receives specific and adapted climate training to align their business activities with financial institutions climate objectives. |

| Data requirements |

The relevant data for this indicator are:

CDP Questionnaire mapping to this indicator:

External sources of data may also be used for the analysis of this indicator. |

| How the assessment will be done |

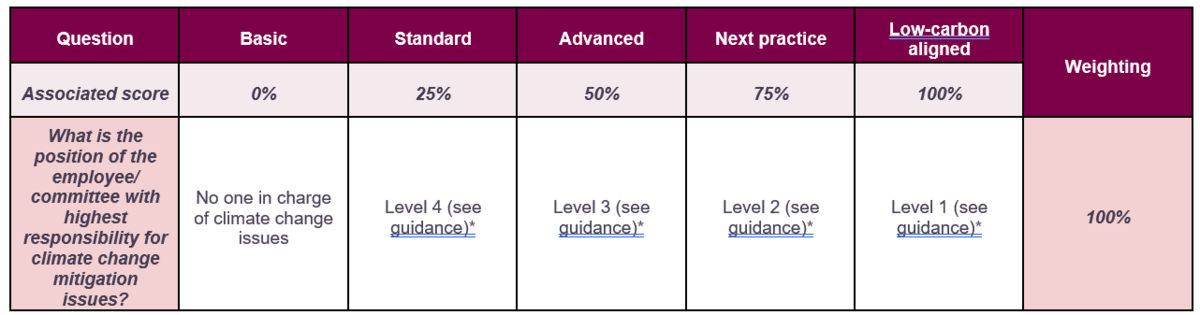

The presence of expertise on topics relevant to climate change and the low-carbon transition at the level of the individual or committee with overall responsibility for it within the company is assessed. The presence of expertise is the condition that must be fulfilled for points to be awarded in the scoring. The analyst determines if the financial institution has expertise as evidenced through a named expert biography outlining capabilities. A cross-check is performed against 5.1 on the highest responsibility for climate change, the expertise should exist at the level identified or the relationship between the structures/experts identified should also be evident. To be awarded Low-carbon aligned, the financial institution must provide examples of how the individual or committee’s expertise has informed credit allocation and/or decision-making processes. The maturity matrix used for the assessment is the following:  “Characteristics of climate change- and low-carbon transition-related expertise” include:

|

| Rationale | LEN 5.2 Climate change oversight capability |

| Rationale of the indicator |

Effective management of the low-carbon transition requires specific expertise related to climate change and its impacts, and their likely direct and indirect effects on the business. Presence of this capability within or closely related to the decision-making bodies that will implement low-carbon transition both indicates financial institution commitment to that transition and increases the chances of success. Even though financial institutions are managing climate change at the Board level or equivalent level, a lack of expertise could be a barrier to successful management of low-carbon transition. |

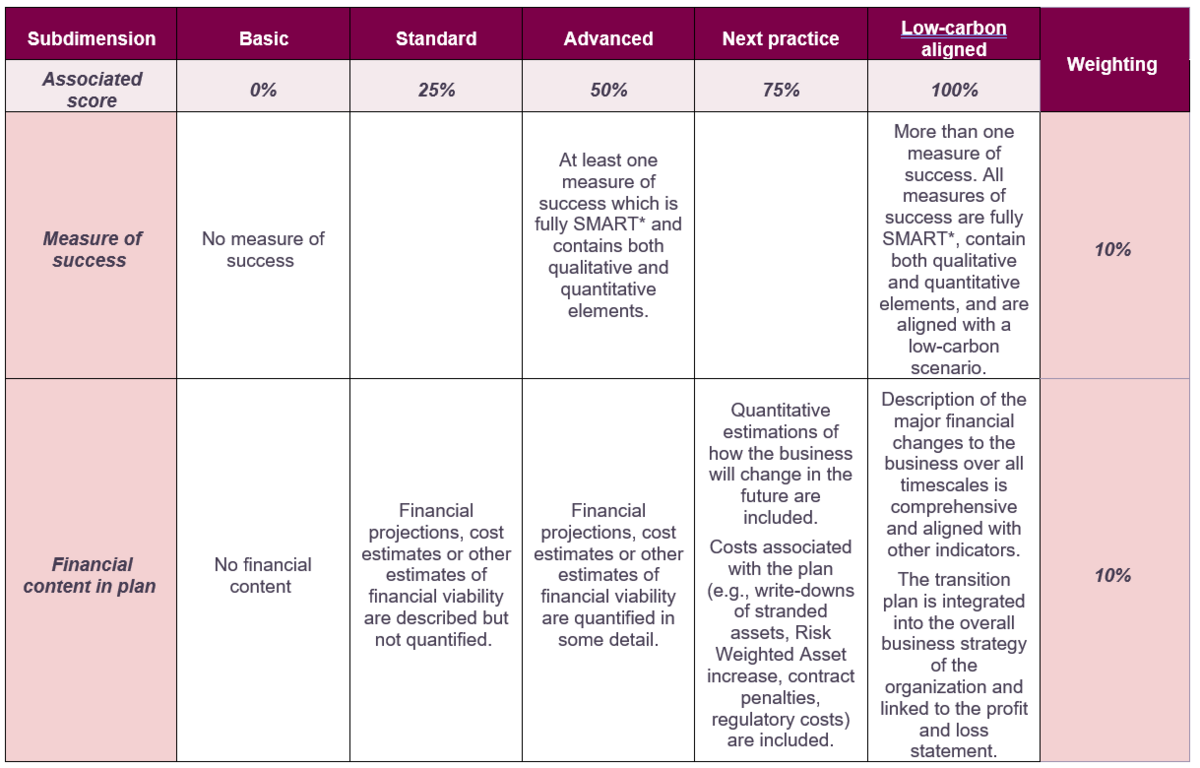

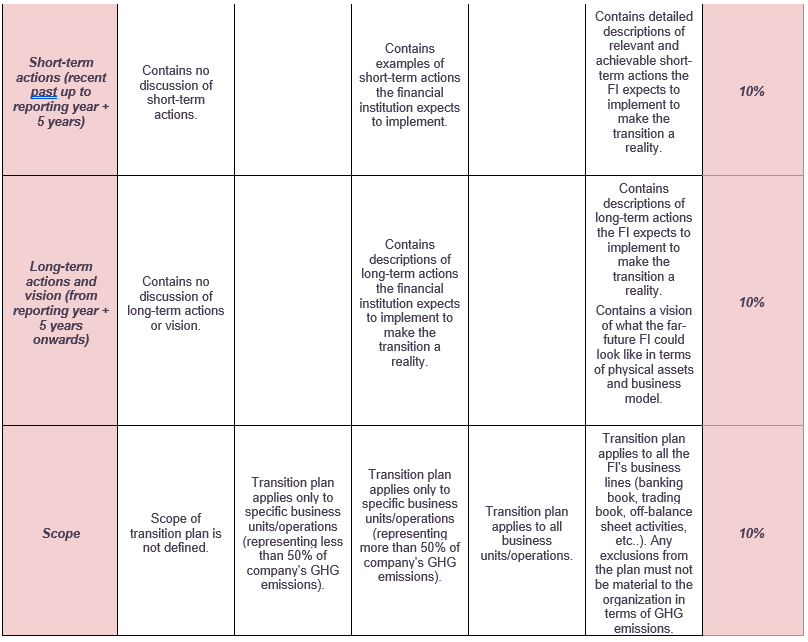

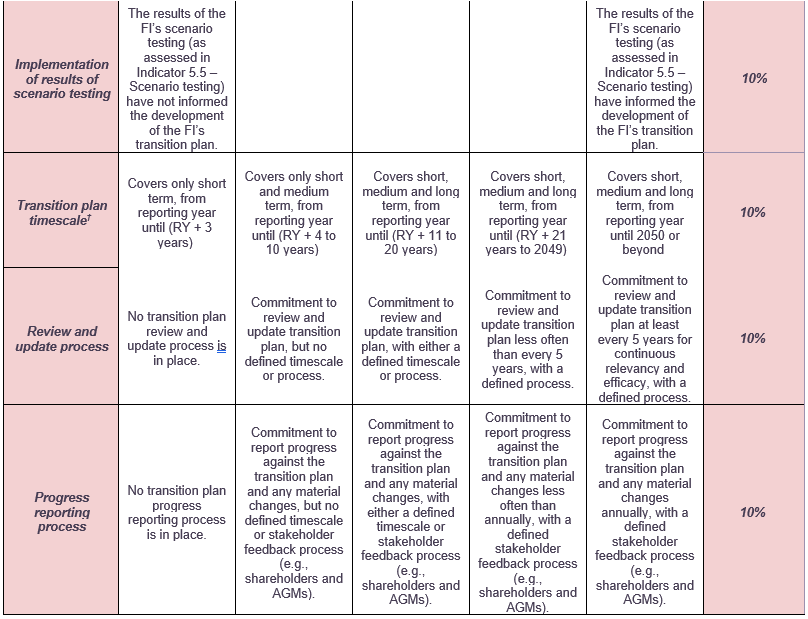

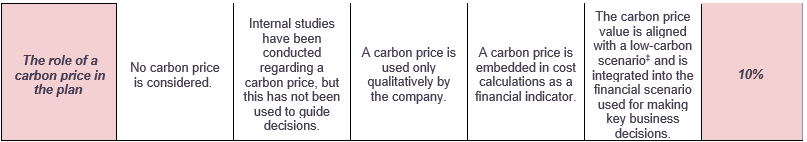

5.3.5.3 LEN 5.3 Low-carbon transition plan

| Description & Requirements | LEN 5.3 Low-carbon transition plan |

|---|---|

| Short description of indicator | The financial institution has a plan on how the financial institution can contribute to financing the transition towards a low-carbon economy |

| Data requirements |

The relevant data for this indicator are:

CDP Questionnaire applying to this indicator:

|

| How the assessment will be done |

|

| Rationale | LEN 5.3 Low-carbon transition plan |

| Rationale of the indicator | All the sectors, including the finance one, will require substantial changes to their business to contribute to a low-carbon economy, over the short, medium and long term, whether it is voluntarily following a strategy to do so or is forced to change by regulations and structural changes to the market. It is better from a risk perspective and impact approach that the changes tied to the transition occur in a planned and controlled manner. |

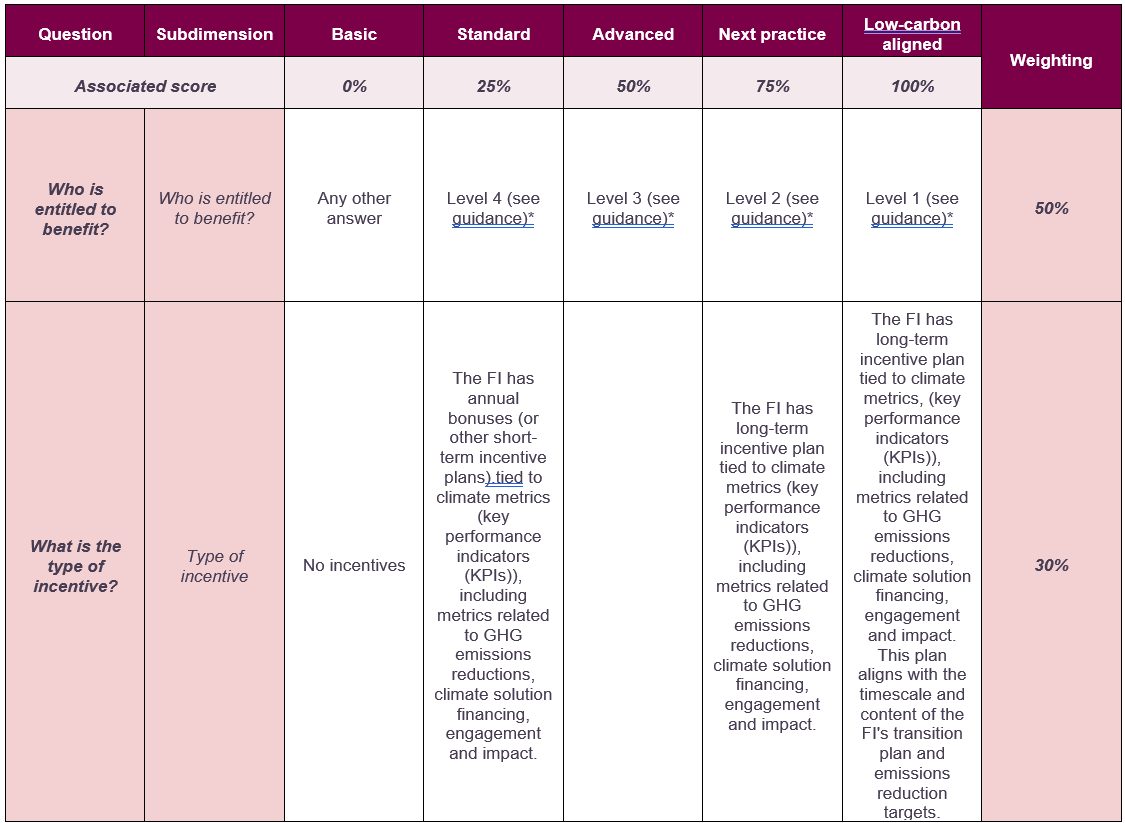

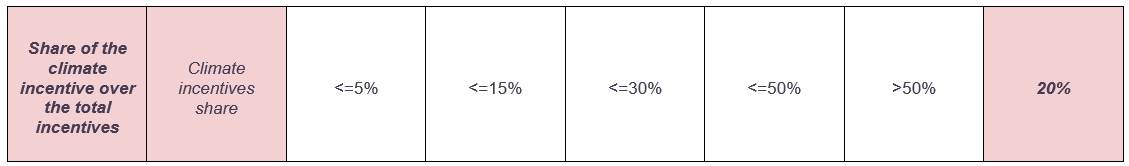

5.3.4.4 LEN 5. 4 Climate change management incentives

| Description & Requirements | LEN 5.4 Climate change management incentives |

|---|---|

| Short description of indicator | The Board’s compensation committee has included metrics for the reduction of GHG emissions in the annual and/or long-term compensation plans of senior executive and front office employees. The company provides financial incentives for the management of climate change issues as defined by a series of relevant indicators. |

| Data requirements |

The relevant data for this indicator are:

CDP Questionnaire mapping to this indicator:

|

| How the assessment will be done |

The analyst verifies if the financial institution has compensation incentives set for senior executive compensation and/or bonuses, that directly and routinely reward specific, measurable financing reduction emissions and/or the future attainment of emissions reduction targets, or other metrics related to the financial institution’s low-carbon transition plan. For cases in which the financial institution's structure does not match the one of the maturity matrix, the assessor should assign a score based on the financial institution’s specific hierarchy (i.e., if climate change management incentives are awarded to the highest level of decision-making within the organization, award “Low-carbon aligned”. If incentives are available one level below the highest level, award “Next practice”, etc.). Note: the wording of the “What is the type of incentive” is based on the Executive Compensation Guidebook for Climate Transition developed by Willis Towers Watson, in partnership with the Climate Governance Initiative, a project in collaboration with the World Economic Forum   Further guidance for each level of seniority is given below: Level 1

Level 2

Level 3

Level 4

|

| Rationale | LEN 5.4 Climate change management incentives |

| Rationale of the indicator |

Executive compensation should be aligned with overall business strategy and priorities. As well as commitments to action the company should ensure that incentives, especially at the executive level, are in place to reward progress towards low-carbon transition. This will improve the likelihood of successful low-carbon transition. Monetary incentives at the executive level are an indication of commitment to successful implementation of a strategy for low-carbon transition. |

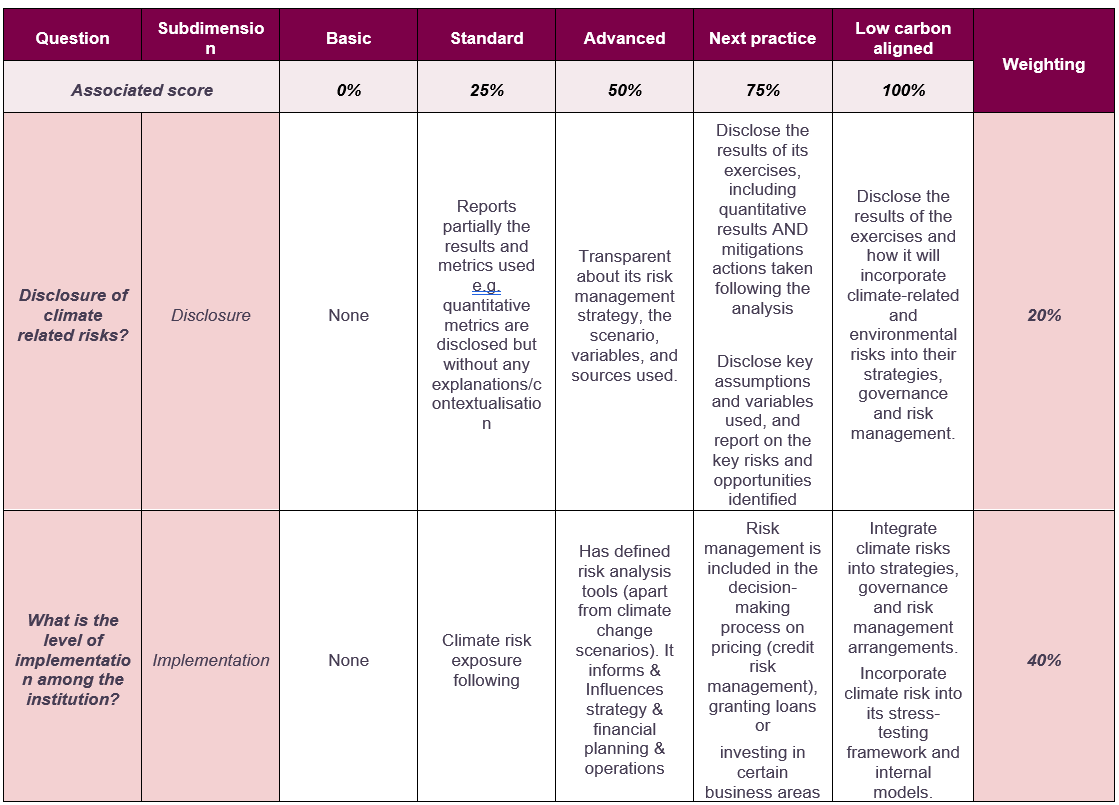

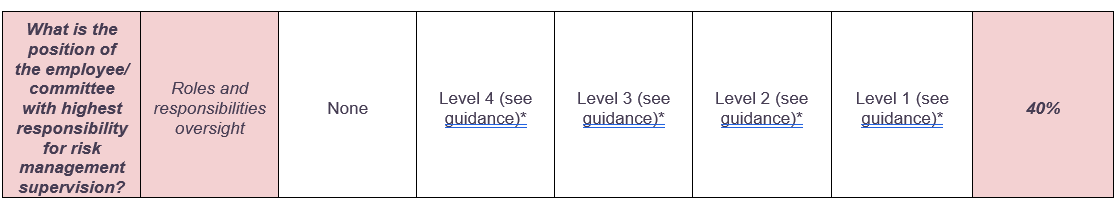

5.3.5.5 LEN 5.5 Climate risk management

| Description & Requirements | LEN 5.5 Climate risk management |

|---|---|

| Short description of indicator | The financial institution is fully considering climate as a systemic risk. As a result, it is integrating climate in its own risk management process, informing its global strategy, and impacting its granting conditions (e.g. climate has a direct impact on the pricing of a loan, Green/Brown Supporting Factor) |

| Data requirements |

The relevant data for this indicator are:

CDP Questionnaire mapping to this indicator:

|

| How the assessment will be done |

The analyst evaluates the description and evidence of the integration of climate risk in its risk management process and strategy   Level 1

Level 2

Level 3

Level 4

|

| Rationale | LEN 5.5 Climate risk management |

| Rationale of the indicator |

Climate has been explicitly identified as a financial risk for years now (25). According to European supervisors, Banks are not on the track to follow their climate risk exposure and managing it (‘a wait-and-see approach is still prevalent’) (26). Even though climate change scenario analysis and testing have turned to be a common practice (with a large heterogeneity (27) in its exercise but this will be the topic of the next section 5.6), climate risk management itself is still lagging in terms of best practice (28) (definition of a climate risk strategy, deployment and implementation, governance, allocation of roles & responsibilities associated with it). 25. Breaking the tragedy of the horizon – climate change and financial stability – speech by Mark Carney. Speech given at Lloyd’s of London. https://www.bankofengland.co.uk/speech/2015/breaking-the-tragedy-of-the-horizon-climate-change-and-financial-stability. 27. https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.climateriskstresstest2021~a4de107198.en.pdf. Expectation: ‘Institutions are expected to incorporate climate-related and environmental risks as drivers of existing risk categories into their risk management framework, with a view to managing, monitoring and mitigating these over a sufficiently long-term horizon, and to review their arrangements on a regular basis.3 |

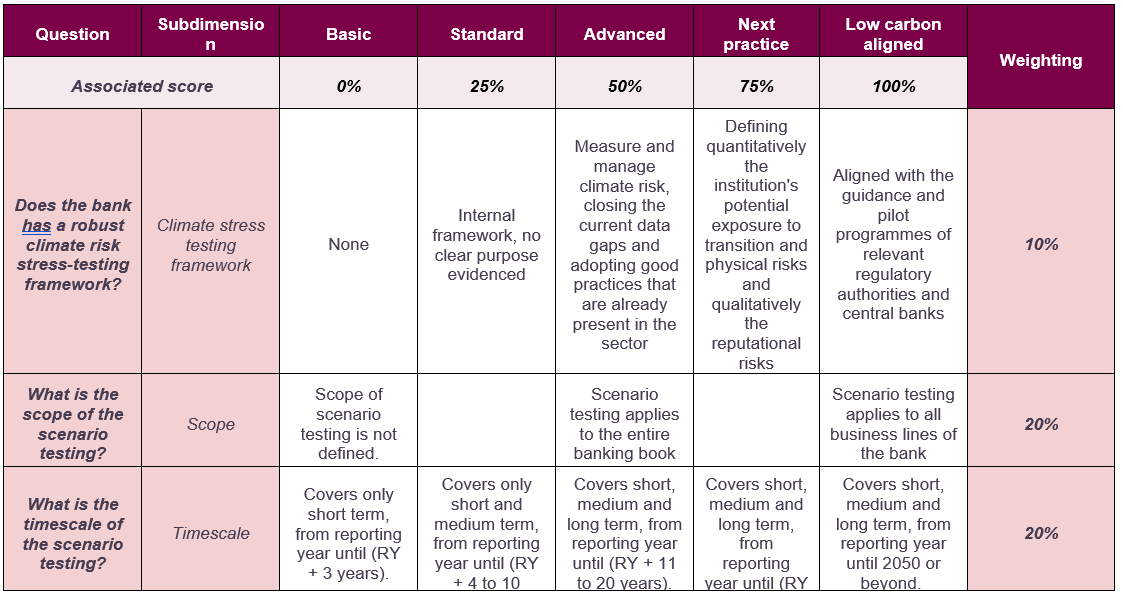

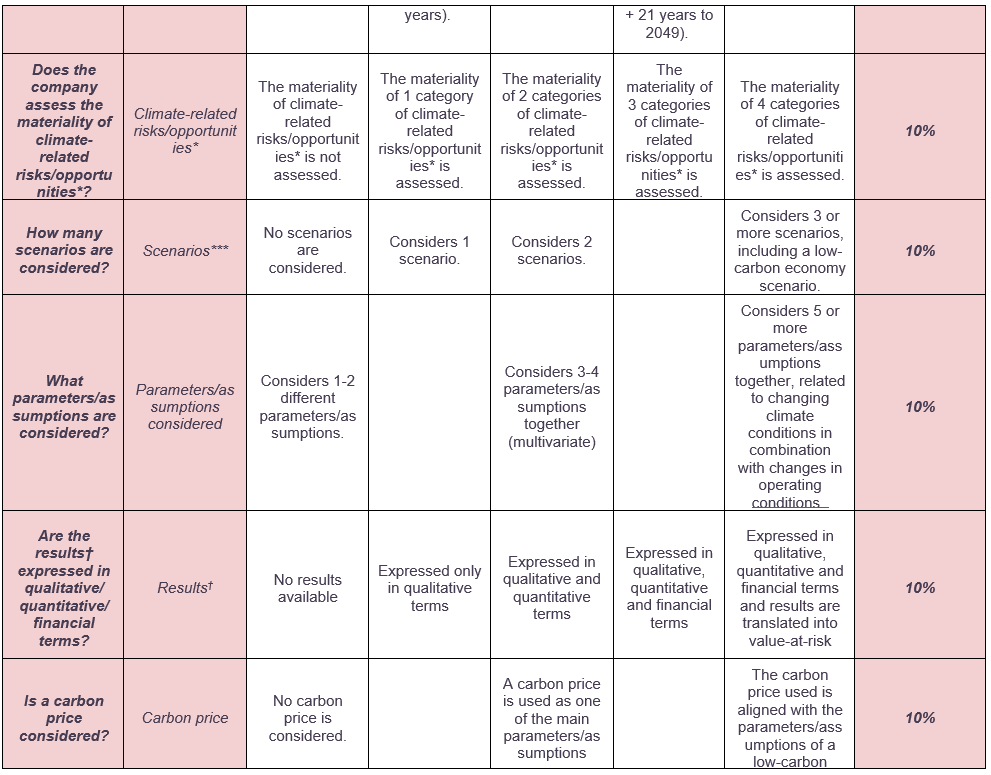

5.3.5.6 LEN 5.6 Climate change scenario testing

| Description & Requirements | LEN 5.6 Climate change scenario testing |

|---|---|

| Short description of indicator | Assessing bank’s climate risk stress-testing framework. |

| Data requirements |

The relevant data for this indicator are:

CDP Questionnaire mapping to this indicator:

|

| How the assessment will be done |

The analyst evaluates the description and evidence of the climate scenario testing for the presence of best-practice elements and consistency with the other reported management indicators. The financial institution description and evidence are compared to the maturity matrix developed to guide the scoring and a greater number of points is allocated for elements indicating a higher level of maturity. Best-practice elements to be identified in the test/analysis include:

Results of stress testing should be presented as business impacts which can include consideration of: Scale: What is the order of magnitude of the potential impact? Timeframe: What can I conclude about the possible timescales over which this will emerge? Asset classes and sectors: What does my analysis tell me about the differential impact of climate change on different asset classes and/or sectors? Valuation: Can I draw out lessons from the way I value individual companies or assets (quantitative or qualitative)? Trends and drivers: What does the analysis tell me about the signals to watch for in order to track climate risks in specific asset classes, sectors or companies? Refer for instance to International Energy Agency (IEA), World Energy Outlook 2019, Annex B, p 758 (30). CO2 prices are displayed by world regions, predicted values in 2030 and 2050. |

| Rationale | LEN 5.6 Climate change scenario testing |

| Rationale of the indicator |

There are a variety of ways of analysing the potential impacts of climate-related changes on a bank, whether these are slow and gradual developments or one-off “shocks”. Supervisors are increasingly calling for techniques such as use of an internal price on carbon, scenario analysis and stress testing to be implemented to enhance banks’ ability to assess climate-related risk. To date, around 60% of European banks do not yet have a climate risk stress-testing framework. It is key to integrate climate risk scenarios into their stress-testing models, with both physical and transition risks, as well as long-and short-term horizons. Scenario stress testing is an important management tool to account for various transmission channels and asset classes. It is important for financial institution to understand the businesses likely to be strongly affected by climate change impacts (both direct and indirect). As this practice is still to be fully onboarded by banks, the ACT methodology thus provides a broad definition of types of testing and analysis which can be relevant to this information requirement, to identify both current and best practices and consider them in the analysis. |

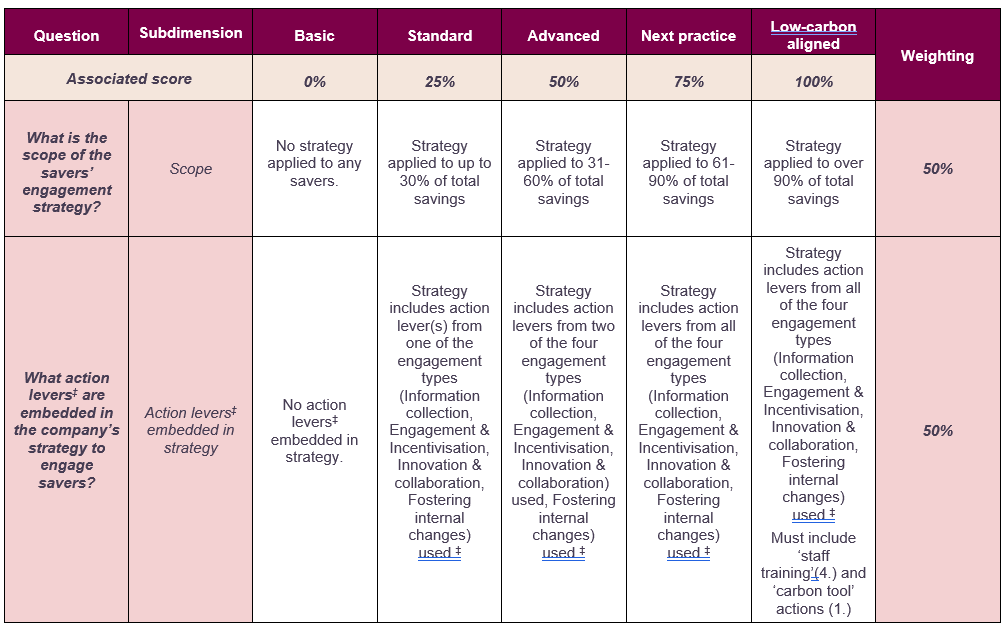

5.3.6 Module 6: Savers engagement

5.3.6.1 LEN 6.1 Strategy to influence savers

| Description & Requirements | LEN 6.1 Strategy to influence savers |

|---|---|

| Short description of indicator |

This indicator assesses the strategic policy and the process which are formalized and implemented into business decision making process to influence, enable or otherwise shift savers’ choices and behaviours in order to reduce:

|

| Data requirements |

The relevant data for this indicator are:

External sources of data may also be used for the analysis of this indicator. |

| How the assessment will be done |

The assessment will assign a maturity score based on the financial institution’s formalized, written strategy regarding its engagement with its savers (corporates and individuals), expressed in a maturity matrix. A financial institution that is placed in the ‘Low-carbon aligned’ category will receive the maximum score. A financial institution which is at a lower level will receive a partial score, with 0 points awarded for having no engagement at all.  Indicative (non-exhaustive) list to help in the matrix assessment: ‡ 1. Information collection (understanding savers behavior) - Collect climate change and carbon preferences at least annually from savers - Promote or develop tools to enable clients calculate the carbon footprint of their lifestyle/activities or assess their contribution to Paris Agreement mitigation goal (for corporates e.g. ACT Step by Step or ACT assessment) 2. Engagement & incentivization (changing savers behavior) - Run an engagement campaign to educate savers about climate change/GHG emissions reductions/other low-carbon transition-related topics for their saving schemes - Offer financial incentives for savers directing their savings towards climate solutions/low carbon activities/helping companies to transition - Provide climate-related training, support, and best practices - Directly work with savers on climate-related topics, such as defining common GHG emission reduction plans for their saving schemes - Promoting sustainable consumption 3. Innovation & collaboration (changing markets) - Run a campaign to encourage innovation to reduce climate impacts on products and services - Collaborate with savers on innovative low-carbon/transition savings products - Report on savings schemes' climate performance to savers 4. Fostering internal changes (teams/tools/processes) - Regular staff training and upskilling on climate-related topics and related saving schemes - Incentivization of relationship managers to put forward climate-positive solutions or funds |

| Rationale | LEN 6.1 Strategy to influence savers |

| Rationale of the indicator |

Relevance of the indicator: Deposits are a key financial resource for many credit institutions. The deposit relationship, whether with a corporate or a retail (consumer) saver, is often one entry point for the institution in order to provide other product and services. Savers engagement is included in this ACT methodology for the following reasons:

Savers can be whether corporates or consumers:

Scoring the indicator: Because of data availability and complexity, a direct measure of the outcome of such engagement is not very feasible at this time. Because there is no taxonomic labelled fund savers (individuals or corporates) could place their money in or because the additionality of the engagement actions made with corporates or individuals is not measurable, the approach of a maturity matrix allows the analyst to consider multiple dimensions of savers engagement and assess them together towards a single score for savers Engagement. |

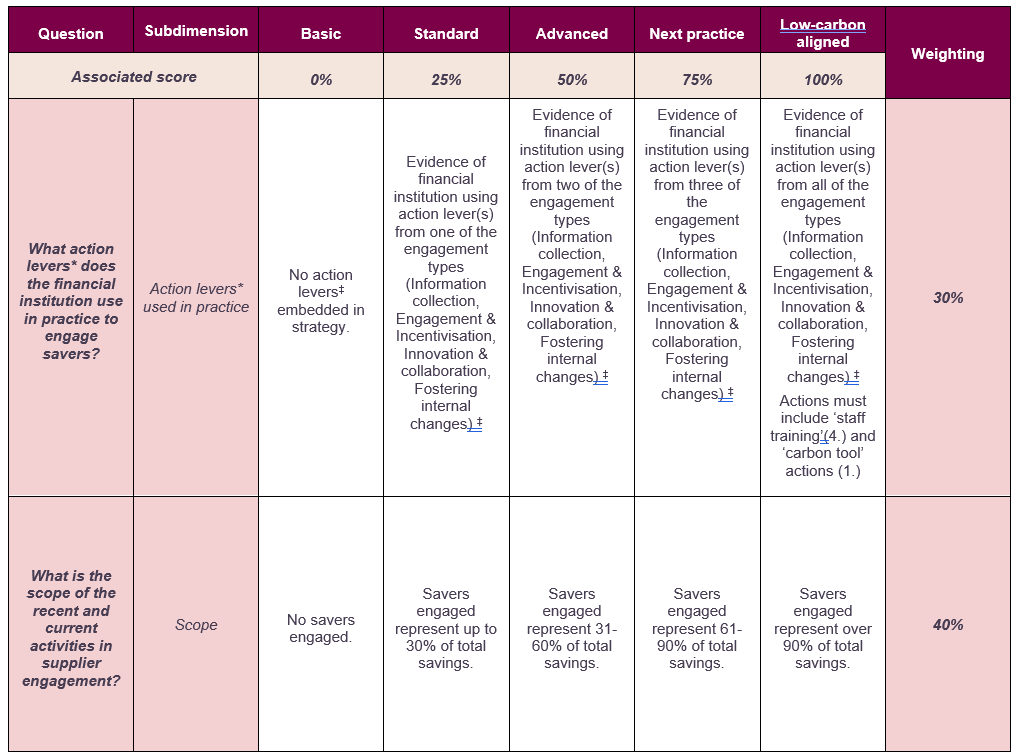

5.3.6.2 LEN 6.2 Activities to influence savers

| Description & Requirements | LEN 6.2 Activities to influence Savers |

|---|---|

| Short description of indicator | This indicator assesses the extent to which the financial institution implements activities and initiatives that help, influence or otherwise enable savers to reduce their GHG emissions. The indicator aims to be a holistic measure of these activities and initiatives, with evidence of implementation and outcomes in the value chain across all products/services. |

| Data requirements |

The relevant data for this indicator are:

External sources of data may also be used for the analysis of this indicator. |

| How the assessment will be done |

The assessment will assign a maturity score based on the financial institution’s demonstration of recent and current activities with its savers, expressed in a maturity matrix. A financial institution that is placed in the ‘Low-carbon aligned’ category will receive the maximum score. A company which is at a lower level will receive a partial score, with 0 points awarded for having no engagement at all. This maturity matrix is indicative but does not show all possible options that can result in a particular score. The financial institution’s responses will be scrutinized by the analyst and then placed on the level in the matrix where the analyst deems it most appropriate.   Action levers must be presented as examples of past/present actions/initiatives, and not be theoretical/embedded in a strategy document (such examples should be scored in indicator 6.1). “Action levers” include, but are not limited to, the following examples, which are grouped into four engagement types (sources: 2022 CDP climate change questionnaire C12.1): Indicative (non-exhaustive) list to help in the matrix assessment: 1. Information collection (understanding savers behavior) - Collect climate change and carbon preferences at least annually from savers - Promote or develop tools to enable clients calculate the carbon footprint of their savings/activities or assess their contribution to Paris Agreement mitigation goal (for corporates e.g. ACT Step by Step or ACT assessment) 2. Engagement & incentivization (changing saver behavior) - Run an engagement campaign to educate savers about climate change/GHG emissions reductions/other low-carbon transition-related topics for their saving schemes - Offer financial incentives for savers directing their savings towards climate solutions/low carbon activities/helping companies to transition - Provide climate-related training, support, and best practices - Directly work with savers on climate-related topics, such as defining common GHG emission reduction plans for their saving schemes - Promoting sustainable consumption 3. Innovation & collaboration (changing markets) - Run a campaign to encourage innovation to reduce climate impacts on products and services - Collaborate with savers on innovative low-carbon/transition savings products - Report on savings schemes' climate performance to savers 4. Fostering internal changes (teams/tools/processes) - Regular staff training and upskilling on climate-related topics and related saving schemes - Incentivization of relationship managers to put forward climate-positive solutions or funds 'The metric used to measure impact depends on the action lever the metric refers to. Examples of “evidence of impact” might include, but are not limited to: o Qualitative example: Feedback from savers e.g. consumers finding insightful to get insights on their behaviors or saying that they appreciate and will use this new knowledge to start their journey on the low-carbon transition o Quantitative example: Increase of X% in sustainable financial products/preferences o Quantitative example: Increase of X% in savers conducting a carbon accounting assessment |

| Rationale | LEN 6.2 Activities to influence savers |

| Rationale of the indicator |

Relevance of the indicator: Savers engagement is included in this ACT methodology for the following reasons:

Savers can be whether corporates or consumers:

Scoring the indicator: Because of data availability and complexity, a direct measure of the outcome of such engagement is not very feasible at this time. Because there is no taxonomic labelled fund savers (individuals or corporates) could place their money in or because the additionality of the engagement actions made with corporates or individuals is not measurable, the approach of a maturity matrix allows the analyst to consider multiple dimensions of savers engagement and assess them together towards a single score for savers Engagement. |

5.3.7 Module 7: Clients engagement

5.3.7.1 LEN 7.1 Strategy to influence clients

| Description & Requirements | LEN 7.1 Strategy to influence clients |

|---|---|

| Short description of indicator | The financial institution has an engagement strategy, ideally governed by policy and integrated into business decision making, to influence, enable, or otherwise shift clients’ business model/activities in order to reduce GHG emissions. |

| Data requirements |

The relevant data for this indicator are:

External sources of data may also be used for the analysis of this indicator. |

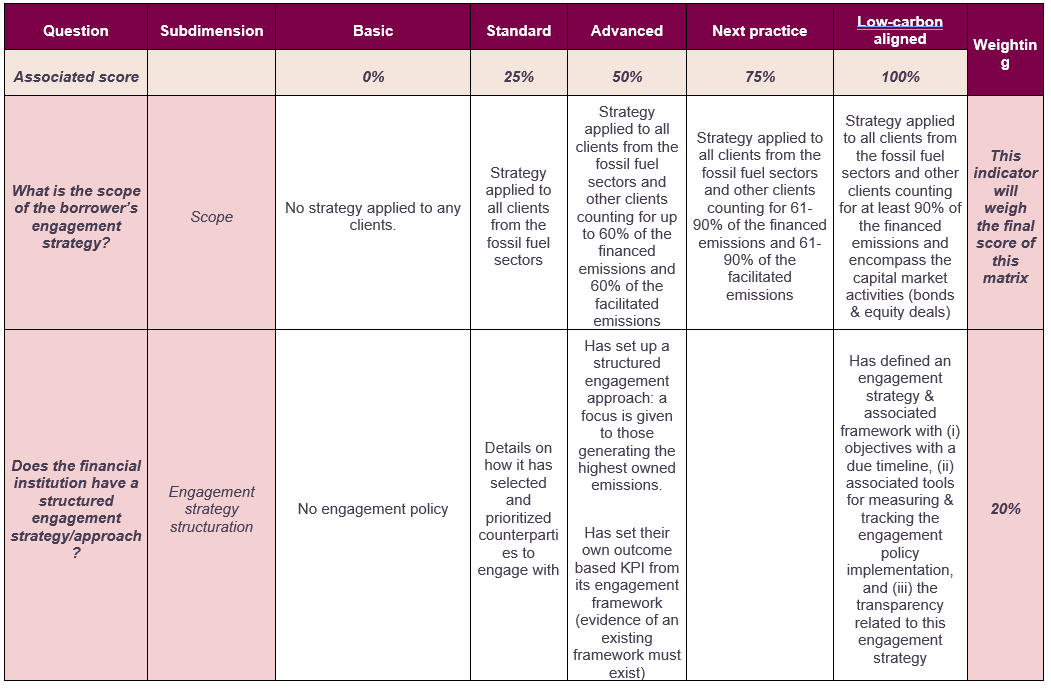

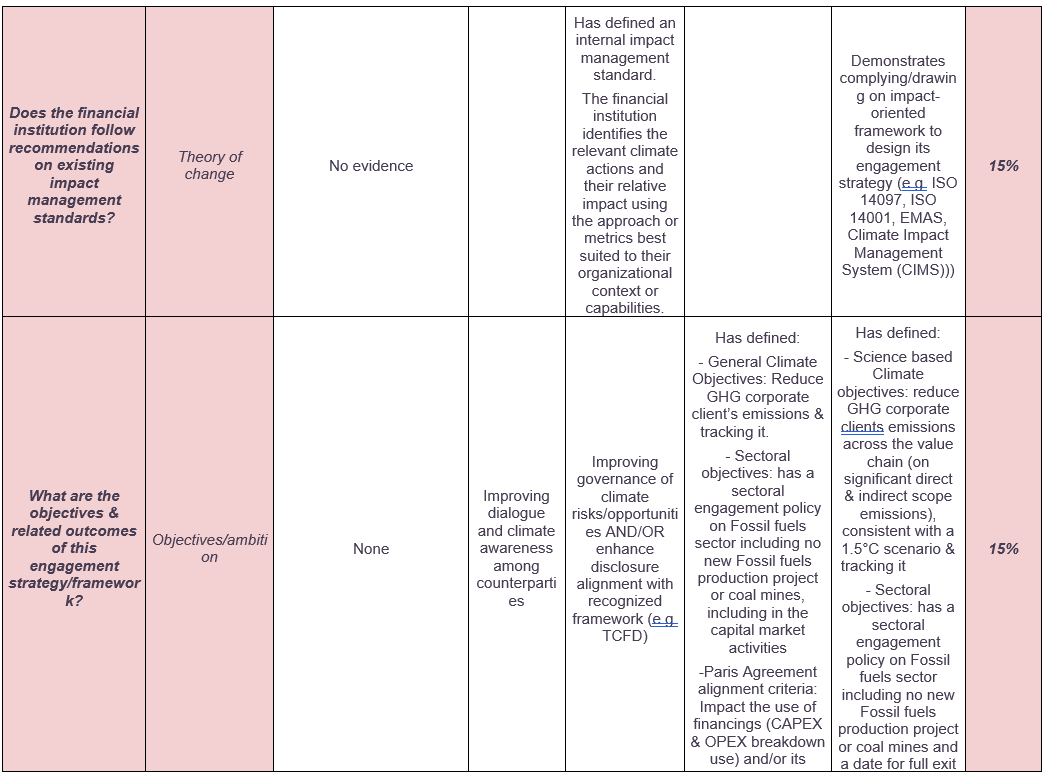

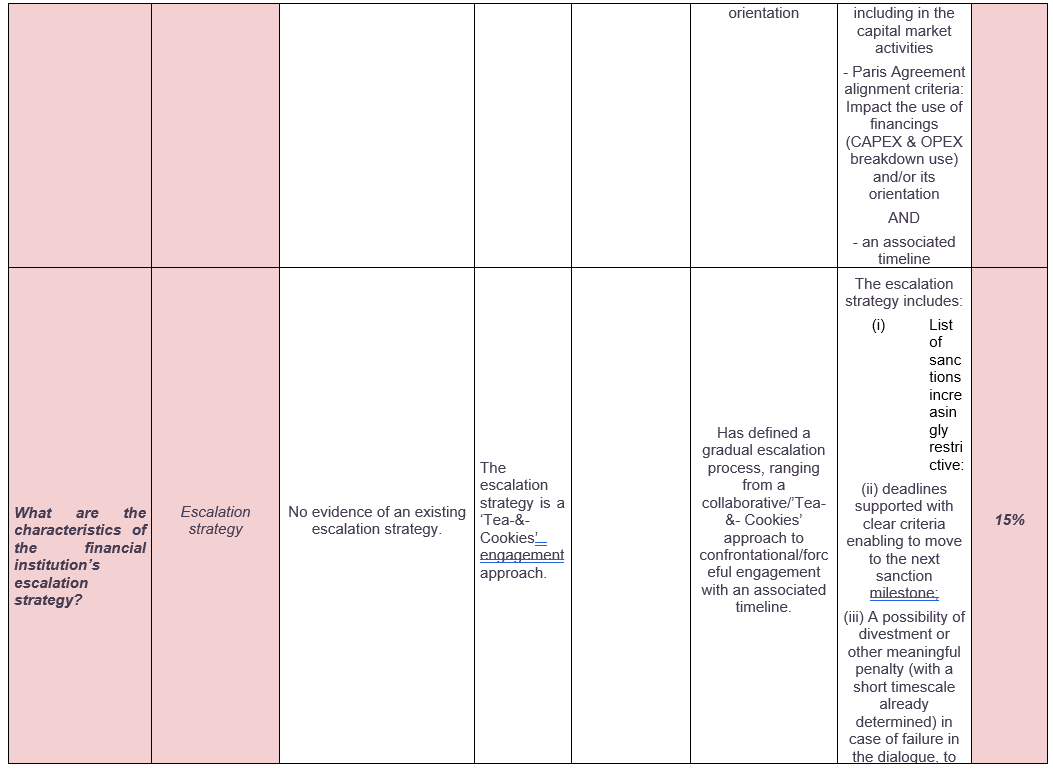

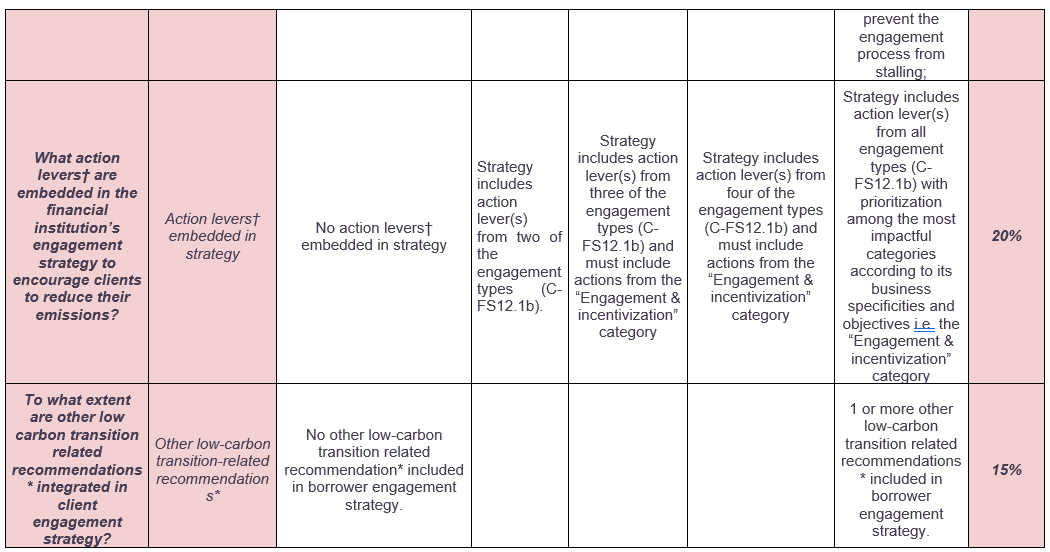

| How the assessment will be done |

The assessment will assign a maturity score based on the financial institution’s formalized, written strategy regarding its engagement with its counterparties, expressed in a maturity matrix. A financial institution placed in the ‘Low-carbon aligned’ category will receive the maximum score. Conversely, a financial institution at a lower level will receive a partial score, with 0 points awarded for having no engagement at all.     “Other low-carbon transition-related recommendations” refers to key aspects of a counterparty’s low-carbon transition, beyond emissions reductions and targets, that financial institutions can engage them on. These aspects can include performance indicators from any ACT performance modules, such as:

Action levers must be embedded in a strategy document, and not be presented as examples of past/present actions/initiatives (such examples should be scored in indicator 7.2). “Action levers” include but are not limited to the following individual action levers, which are grouped into five engagement types (sources: 2022 CDP climate change questionnaire CDP 12.1b (C-FS12.1b) (Banking/Asset manager):

|

| Rationale | LEN 7.1 Strategy to influence clients |

| Rationale of the indicator |

Relevance of the indicator: Strategies to influence counterparties are included in this ACT methodology for the following reasons:

Scoring the indicator: Because of data availability and complexity, a direct measure of the outcome of such engagement is not very feasible at this time. It is often challenging to quantify the emission reduction potential and outcome of collaborative activities with the borrower. Therefore, the approach of a maturity matrix allows the analyst to consider multiple dimensions of engagement and assess them together towards a single score for a strategy related to engagement with clients. |

5.3.7.2 LEN 7.2 Activities to influence clients

| Description & Requirements | LEN 7.2 Activities to influence clients |

|---|---|

| Short description of indicator | This indicator assesses the extent to which the financial institution implements activities and initiatives that help, influence or otherwise enable clients to reduce their GHG emissions. The indicator aims to be a holistic measure of these activities and initiatives, with evidence of implementation and outcomes in the clients value chain across all products/services. |

| Data requirements |

The relevant data for this indicator are:

CDP Questionnaire mapping to this indicator:

External sources of data may also be used for the analysis of this indicator. |

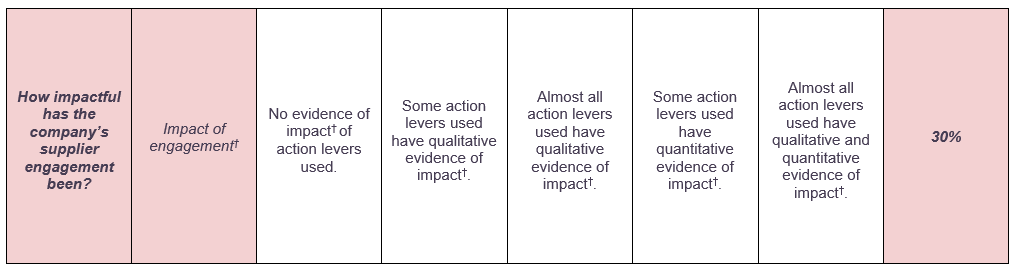

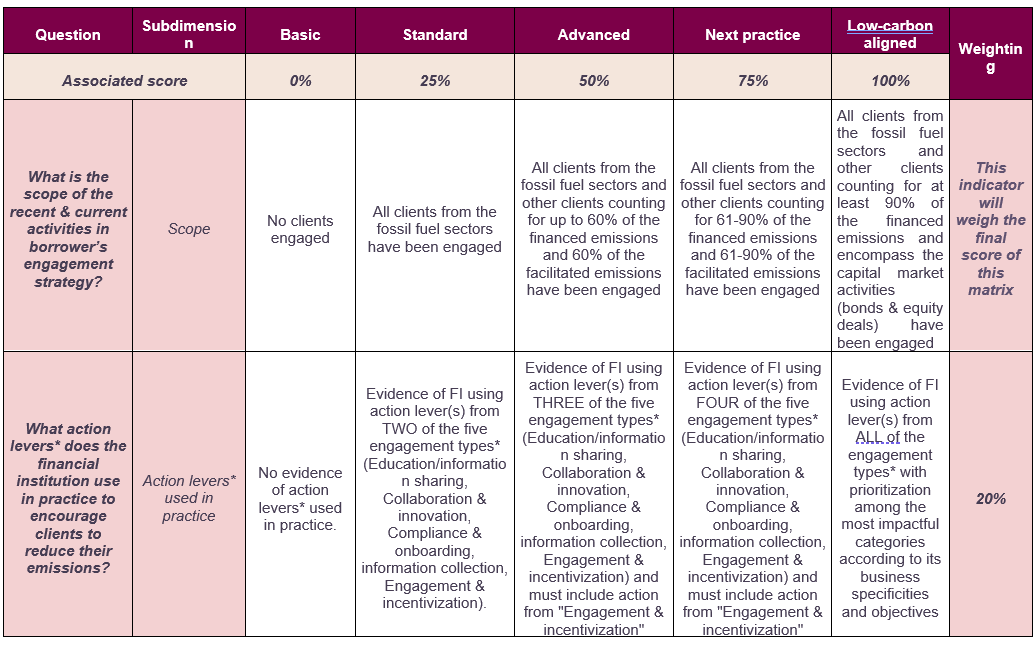

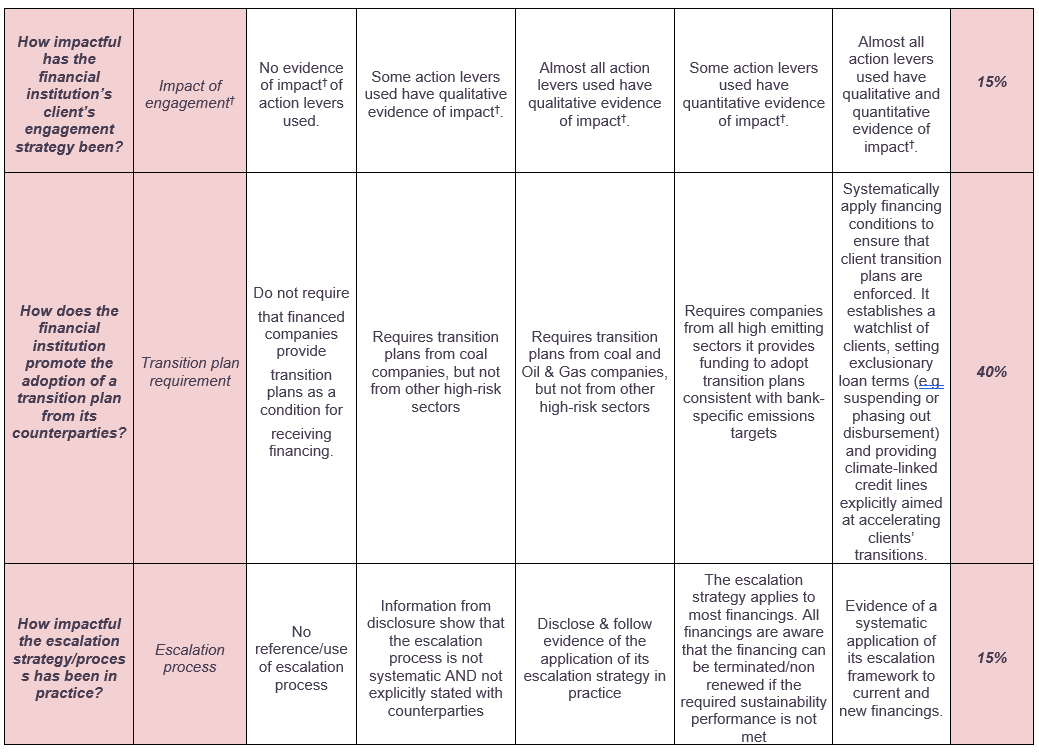

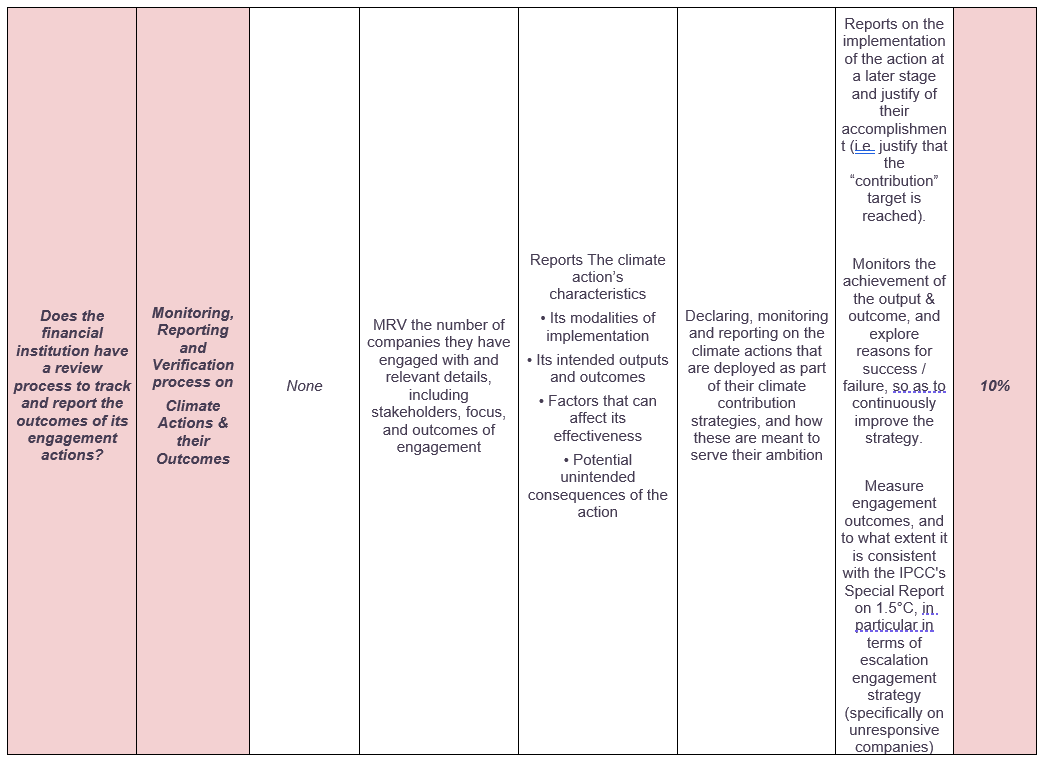

| How the assessment will be done |

The assessment will assign a maturity score based on the financial institution’s demonstration of recent and current activities and initiatives with its clients, expressed in a maturity matrix. A financial institution that is placed in the ‘Low-carbon aligned’ category will receive the maximum score. A financial institution which is at a lower level will receive a partial score, with 0 points awarded for having no engagement at all. This maturity matrix is indicative but does not show all possible options that can result in a particular score. The financial institution’ responses will be scrutinized by the analyst and then placed on the level in the matrix where the analyst deems it most appropriate.

|

| Rationale | LEN 7.2 Activities to influence clients |

| Rationale of the indicator |

Relevance of the indicator: Activities to influence clients are included in this ACT methodology for the following reasons: Financial institutions have the ability to influence the climate strategy and performance of clients through their financial products or services (capital market). The downstream money value chain represents the largest source of emissions and risks for financial institutions and must be addressed through a proper ambitious engagement strategy. Scoring the indicator: Because of data availability and complexity, a direct measure of the outcome of such engagement is not very feasible at this time. It is often challenging to quantify the emission reduction potential and outcome of engagement activities. Therefore, the approach of a maturity matrix allows the analyst to consider multiple dimensions of engagement and assess them together towards a single score for a strategy related to engagement with clients. |

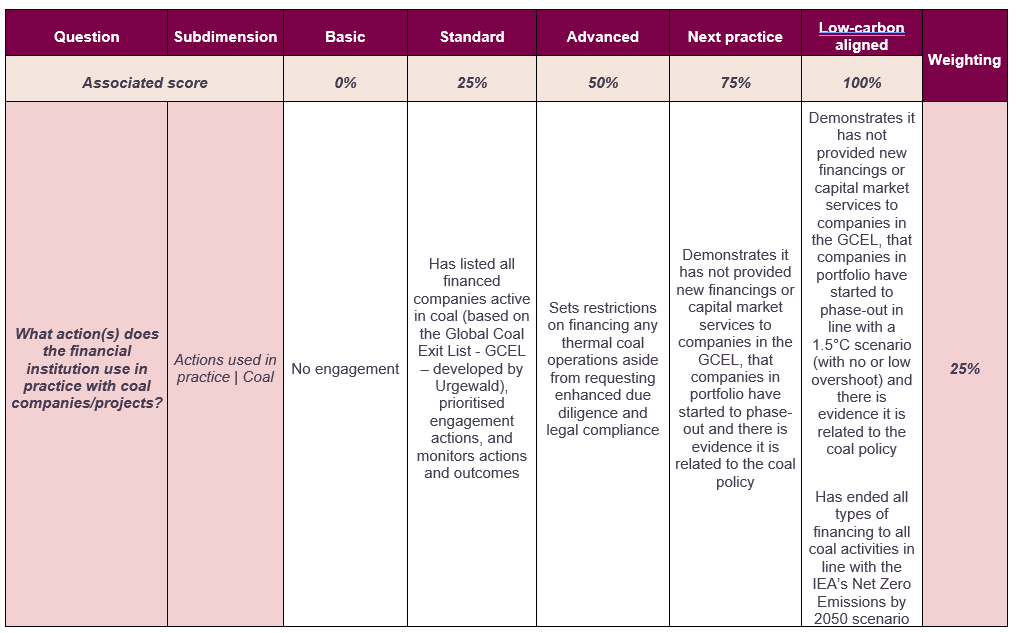

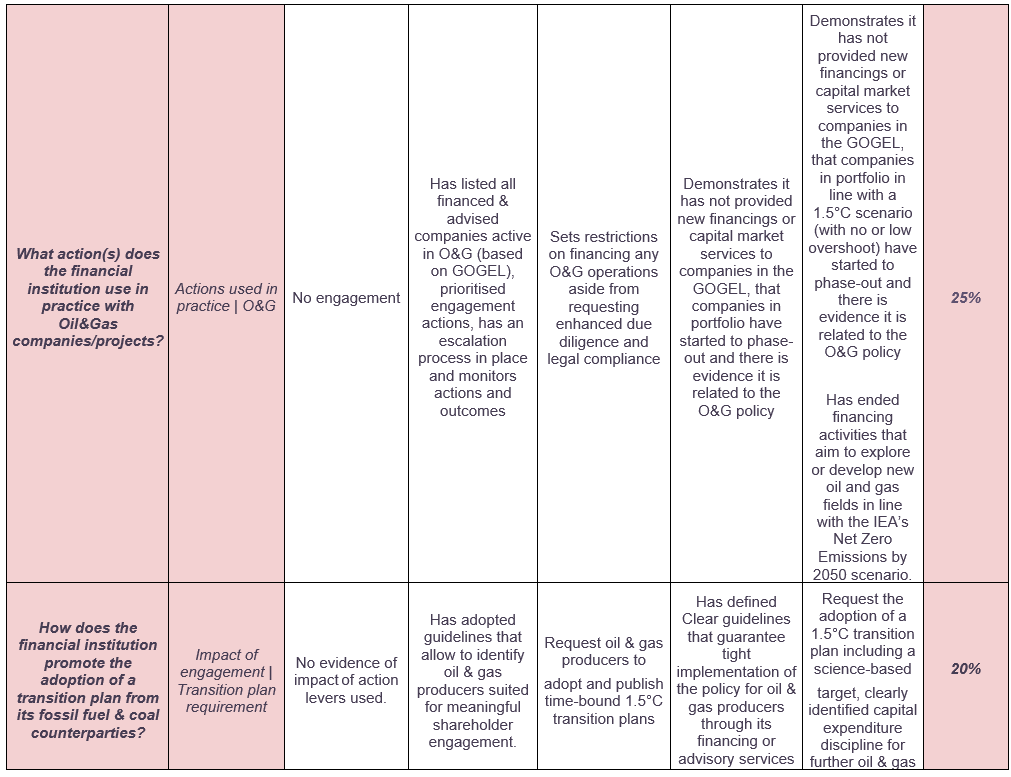

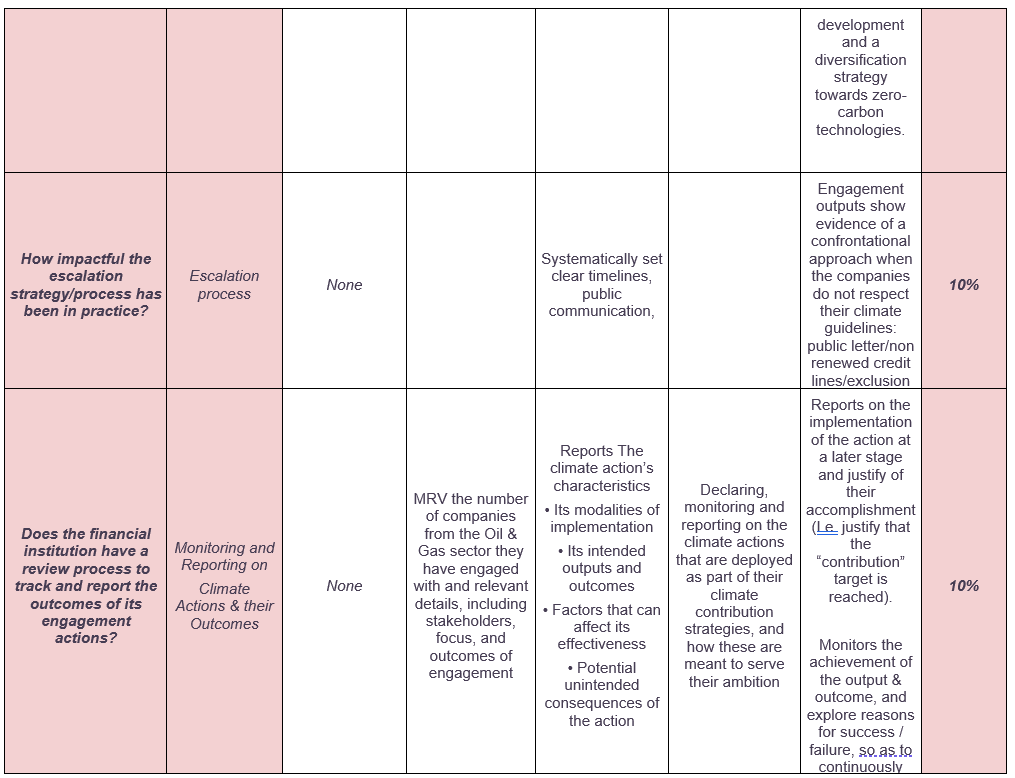

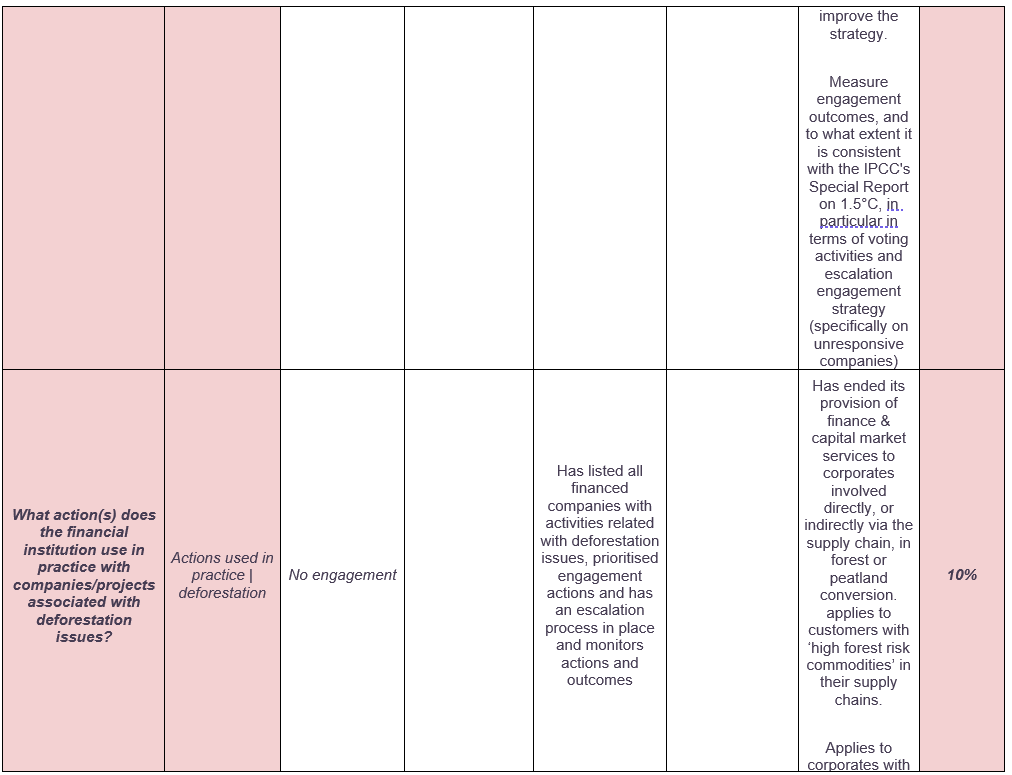

5.3.7.3 LEN 7.3 Activities to influence clients with fossil fuel and/or deforestation-linked activities

| Description & Requirements | LEN 7.3 Activities to influence clients with fossil fuel and/or deforestation-linked activities |

|---|---|

| Short description of indicator | This indicator assesses the extent to which the financial institution implements activities and initiatives that help, influence or otherwise enable Oil & Gas client’s transition. The indicator aims to be a holistic measure of these activities and initiatives, with evidence of implementation and outcomes in the clients ‘value chain across all products/services. |

| Data requirements |

The relevant data for this indicator are:

External sources of data may also be used for the analysis of this indicator. |

| How the assessment will be done |

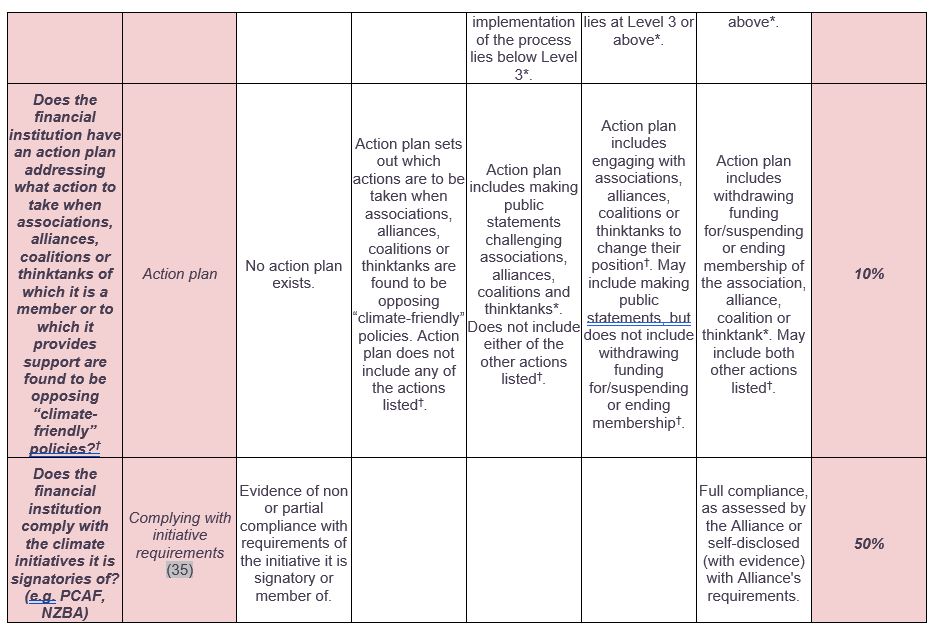

The assessment will assign a maturity score based on the financial institution’s demonstration of recent and current activities and initiatives with its clients operating in oil & gas sector and deforestation linked activities, expressed in a maturity matrix. A financial institution that is placed in the ‘Low-carbon aligned’ category will receive the maximum score. A financial institution which is at a lower level will receive a partial score, with 0 points awarded for having no engagement at all. This maturity matrix is indicative but does not show all possible options that can result in a particular score. The financial institution‘s responses will be scrutinized by the analyst and then placed on the level in the matrix where the analyst deems it most appropriate.      |

| Rationale | LEN 7.3 Activities to influence clients with fossil fuel and/or deforestation-linked activities |

| Rationale of the indicator |

Relevance of the indicator: Activities to influence Oil & Gas clients and deforestation-linked activities are included in this ACT methodology for the following reasons:

Scoring the indicator: Because of data availability and complexity, a direct measure of the outcome of such engagement is not very feasible at this time. It is often challenging to quantify the emission reduction potential and outcome of engagement activities. Therefore, the approach of a maturity matrix allows the analyst to consider multiple dimensions of engagement and assess them together towards a single score for all the activities related to Client Engagement for Oil & Gas sector and deforestation linked-activities. In the case where the financial institution has no exposition to Oil & Gas activities, nor through capital market activities, the tool will put more weight on the 7.1 and 7.2 indicators and 7.3 will account for 2% of total module 7 weighting, instead of 8%. 7.1 and 7/2 indicators weight will respectively be 7% and 11%. In the case where the financial institution has no exposition to deforestation linked activities, nor through capital market activities, the tool will put more weight on the 7.1 and 7.2 indicators and 7.3 will account for 6% of total module 7 weighting, instead of 8%. 7.1 and 7.2 indicators weight will respectively be 5% and 9%. |

5.3.8 Module 8: Policy engagement

The indicators in the Policy Engagement module are based on the “Investor expectations on corporate lobbying” guide (2018) developed by IIGCC and have adapted for financial institutions. Feel free to refer to the guide for additional context and rationale behind the indicators. This module assesses whether lobbying activities align with the Paris Agreement.

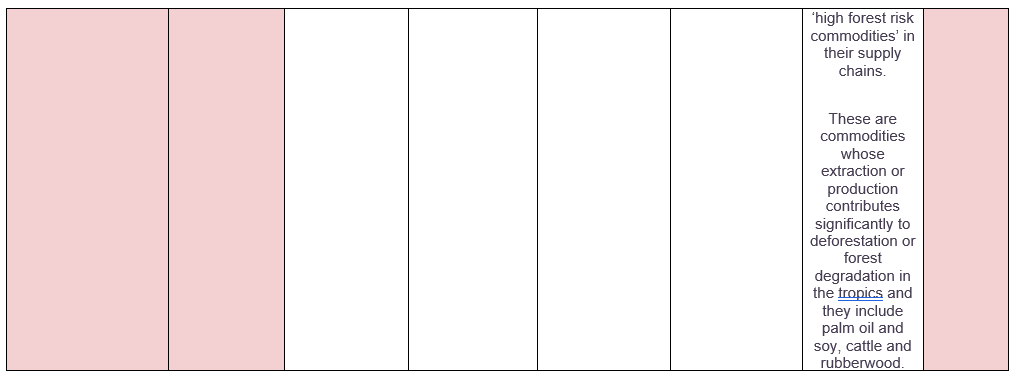

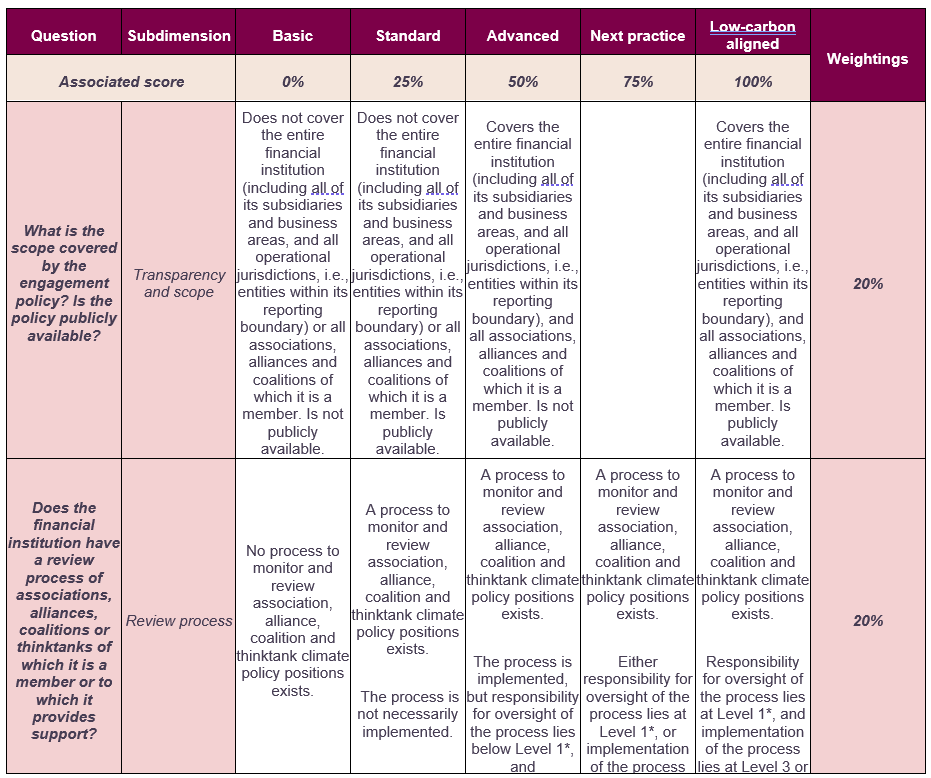

5.3.8.1 LEN 8.1 Financial institution policy on engagement with associations, alliances, coalitions or thinktanks

| Description & Requirements | LEN 8.1 Financial institution policy on engagement with associations, alliances, coalitions or thinktanks |

|---|---|

| Short description of indicator | The financial institution has a policy on what action to take when associations, alliances, coalitions or thinktanks of which it is a member or to which it provides support are found to be opposing “climate-friendly” policies. |

| Data requirements |

The relevant data for this indicator are:

CDP Questionnaire mapping to this indicator:

External sources of data may also be used for the analysis of this indicator. |

| How the assessment will be done |

The analyst will evaluate the description and evidence of the policy on trade associations and climate change for the presence of best practice elements and consistency with the other reported management indicators. The financial institution description and evidence will be compared to the maturity matrix developed to guide the scoring and a greater number of points will be allocated for elements indicating a higher level of maturity. Maximum points are awarded if all these elements are demonstrated. Best practice elements to be identified in the test/analysis include:

Further guidance for each level of seniority is given below: Level 1

Level 2

Level 3

Level 4

Actions a financial institution can take when associations, alliances, coalitions or thinktanks of which it is a member or to which it provides support are found to be opposing “climate-friendly” policies follow a hierarchy of severity, as follows (source: (36), (37)):

|

| Rationale | LEN 8.1 Financial institution policy on engagement with associations, alliances, coalitions or thinktanks |

| Rationale of the indicator |

Associations, alliances, coalitions and thinktanks are a key instrument by which financial institution can indirectly influence policy on climate. Thus, when associations, alliances, coalitions and thinktanks take positions, which are negative for climate, financial institutions need to take action to ensure that this negative influence is countered or minimized. This indicator is consistent with the ACT Framework and ACT Guidelines and common to the other sectoral methodologies. Update has been made on the addition of a new category dealing with the compliance if the financial institution with the climate initiatives it is member or signatory of. To date, climate initiatives or alliances do have a lot of members and have active positions in favour of climate. Still, actions by the members themselves sometimes lag behind. The idea is to assess the potential greenwashing of some actors. |

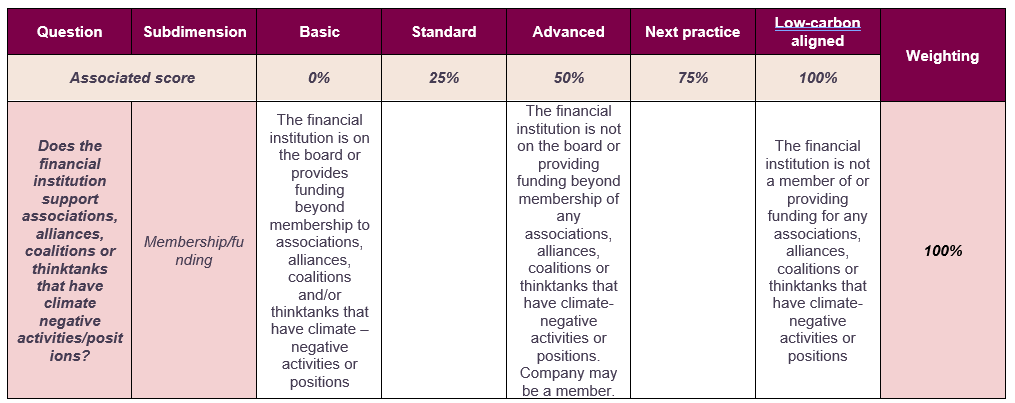

5.3.8.2 LEN 8.2 Associations, alliances, coalitions and thinktanks supported do not have climate-negative activities or positions

| Description & Requirements | LEN 8.2 Associations, alliances, coalitions and thinktanks supported do not have climate-negative activities or positions |

|---|---|

| Short description of indicator | The financial institution is not on the Board of, providing funding beyond membership to, or otherwise supporting any associations, alliances, coalitions or thinktanks that have climate-negative activities or positions. |

| Data requirements |

The relevant data for this indicator are:

CDP Questionnaire mapping to this indicator:

External sources of data may also be used for the analysis of this indicator. |

| How the assessment will be done |

The list of associations, alliances, coalitions and thinktanks declared in the CDP data and other external sources relating to the company is assessed against a list of associations, alliances, coalitions and thinktanks that have climate-negative activities or positions (InfluenceMap is usually used for this (38)). (Consideration should be given as to whether these associations, alliances, coalitions and thinktanks in turn are members of or otherwise support other such organisations that have climate-negative activities or positions.) Such activities or positions could include lobbying against climate policies and practices. The results will be compared to any policy described in 8.1 (“Financial institution on engagement with associations, alliances, coalitions or thinktanks”).  |

| Rationale | LEN 8.2 Associations, alliances, coalitions and thinktanks supported do not have climate-negative activities or positions |

| Rationale of the indicator | Associations, alliances, coalitions and thinktanks are key instruments by which financial institution can indirectly influence policy on climate. Thus, participating in associations, alliances, coalitions and thinktanks which actively lobby against climate-positive legislation is a negative indicator and likely to obstruct low-carbon transition. |

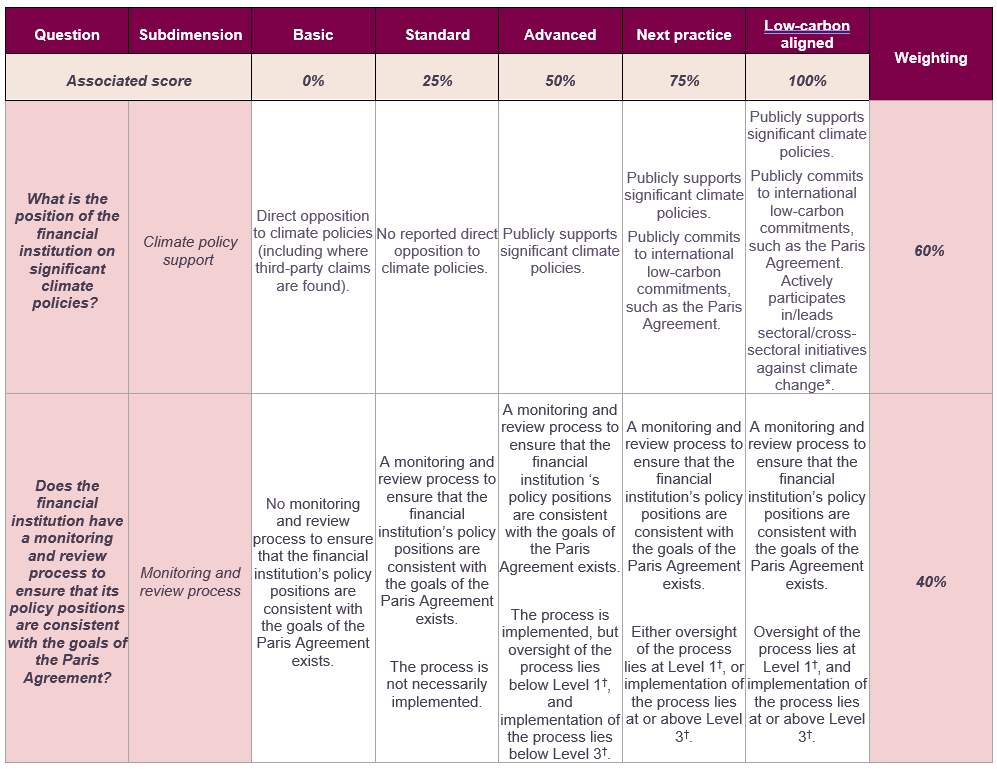

5.3.8.3 LEN 8.3 Position on significant climate policies

| Description & Requirements | LEN 8.3 Position on significant climate policies |

|---|---|

| Short description of indicator | The financial institution is not opposed to any significant climate relevant policy and/or supports climate-friendly policies. |

| Data requirements |

The relevant data for this indicator are:

CDP Questionnaire mapping to this indicator:

External sources of data shall also be used for the analysis of this indicator (e.g. RepRisk database, press news, actions in standard development) |

| How the assessment will be done |

The analyst evaluates the description and evidence on financial institution position on relevant climate policies for the presence of best practice elements, negative indicators and consistency with the other reported management indicators. The financial institution description and evidence will be compared to the maturity matrix developed to guide the scoring and a greater number of points will be allocated for elements indicating a higher level of maturity.

Examples of sectoral/cross-sectoral initiatives against climate change might include, but are not limited to:

Further guidance for each level of seniority is given below: Level 1

Level 2

Level 3

Level 4

|

| Rationale | LEN 8.3 Position on significant climate policies |

| Rationale of the indicator | Policy and regulation that acts to promote transition to a low-carbon economy is key to the success of the transition. Financial institutions should not oppose effective and well-designed regulations in these areas but should support them. |

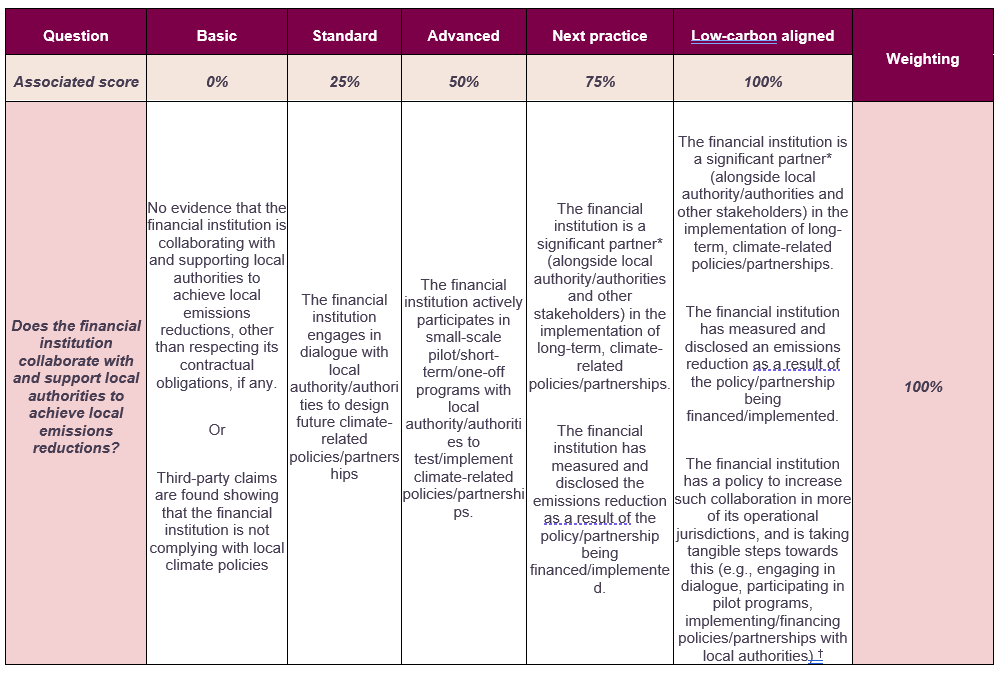

5.3.8.4 LEN 8.4 Collaboration with local public authorities

| Description & Requirements | LEN 8.4 Collaboration with local public authorities | |

|---|---|---|

| Short description of indicator | This indicator evaluates the extent to which the financial institution collaborates with local public authorities to achieve local emissions reductions. While indicator 8.3 “Position on significant climate policies” relates to national and international policies, this indicator assesses the financial institution’s engagement with sub-national public authorities, both in terms of climate-related policy engagement and the establishment of climate-related partnerships. | |

| Data requirements |

The relevant data for this indicator are:

CDP Questionnaire mapping to this indicator:

External sources of data shall also be used for the analysis of this indicator. |

|

| How the assessment will be done |

The analyst evaluates the description and evidence of the financial institution’s collaboration with local authorities for the presence of best-practice elements. Collaboration generally falls into two main categories, policy engagement and collective action/partnerships. Policy engagement could range from dialogue between the financial institution and local authority around the development of new climate-related policies, to participation in local pilot programs to finance these policies, to large-scale support for and implementation of these policies. Collective action/partnerships could range from participation in working groups, roundtables, ongoing initiatives, events and/or platforms for local authorities and companies to advance specific issues related to climate change/emissions reduction, to large-scale public-private partnerships (PPPs) with a climate change/emissions reduction focus. In general, a partnership can only be classed as such if it goes beyond a mere contract between the public authority and the financial institution. It must be a collaboration that works to improve the current system/process and displays additionality (the collaboration reduces GHG emissions beyond business as usual, meaning the reductions would not have happened had the collaboration not been implemented). For example, a contract between a transport operator and a public authority would not be enough to be classed as a partnership by itself, whereas a partnership to reduce local GHG emissions by increasing the share of electric/hybrid/hydrogen buses and promoting greater uptake of public transport within the local area would be sufficient. While the thematic areas of these collaborations will vary depending on the sector assessed, they should generally fall into one or more of four broad categories:

In each case, the level of maturity will depend on the level of commitment from the financial institution, and whether there is evidence that the collaboration has been successful in achieving local emissions reductions. The financial institution description and evidence are compared to the maturity matrix developed to guide the scoring and a greater number of points are allocated for elements indicating a higher level of maturity.  A financial institution can be classed as a “significant partner” if the policy/partnership would not exist, or be significantly smaller/less successful, without the financial institution’s involvement/financings. The financial institution must be one of the few largest or most invested stakeholders in the policy/partnership. Analysts should consider the size of the financial institution assessed. For example, financial institution operating in a single jurisdiction are not expected to be involved in collaboration with public authorities outside of that jurisdiction, and could still score Low-carbon aligned if they met each of the other criteria (for example, if they had demonstrated emissions reductions as a result of the policy/partnership being implemented/financed, and had a policy to become involved in more collaboration within their operational jurisdiction). |

|

| Rationale | LEN 8.4 Collaboration with local public authorities | |

| Rationale of the indicator | Collaboration with local authorities can be a key instrument by which financial institution can indirectly influence policy on climate in their territory. Thus, participating actively in local dialogues shows leadership in climate actions and can significantly help climate policies enforcement. | |

5.3.9 Module 9: Business model

A financial institution may transition its business activities to other areas to remain profitable in a low-carbon economy. The financial institution’s future business model should enable it to decouple financial results from GHG emissions, in order to help companies meet the constraints of a low-carbon transition while continuing to generate value. This can be done by developing activities outside the core business of the financial institution.

This module will aim to assess whether financial institutions demonstrate the inclusion of criteria of analysis in their appraisal of economic value. New standard of credit risk analysis shall also be assessed and rewarded in this module.

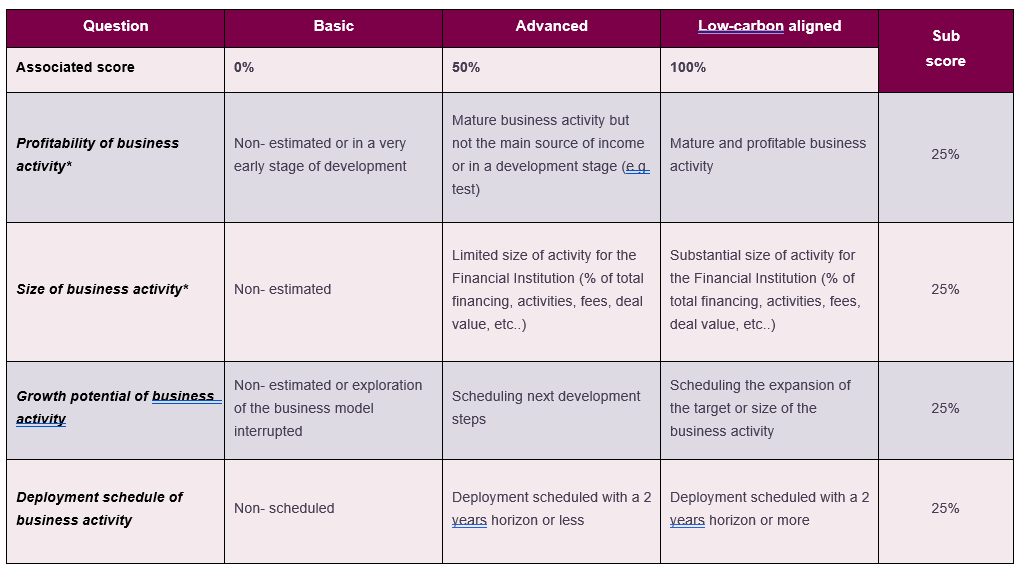

This module aims to identify both relevant current business activities and those still at a burgeoning stage. It is recognised that transition to a low-carbon economy, with the associated change in business models required to companies, will take place over a number of years. The analysis will thus seek to identify and reward project financings at an early stage as well as more mature business activity financings, although the latter (i.e. substantially sized, profitable, and/or expanding) business activities will be better rewarded.

The present module has been driven notably by the following considerations:

- Focus on new business activities (climate solutions)

- High emissive / involved in high emissive activity companies should be benchmarked by quantitative modules (not in business model module)

- Score will be based on long-term viability of the financial institution’s financings towards business activities compatible with/contributing to a the low-carbon economy

- Do the financings help to bridge the climate finance gap?

- Is there a need to change the fundamental business activities? e.g. no longer provide financings to fossil fuel companies or provide bonified loan to green project or transitioning companies or penalize high emissive companies.

- How does the emissive activities/sectors link with the financings?

- Financing new business models vs. transitioning existing business model

We shouldn’t penalize financial institutions who can’t shift their financings as they are not financing high emitting sectors

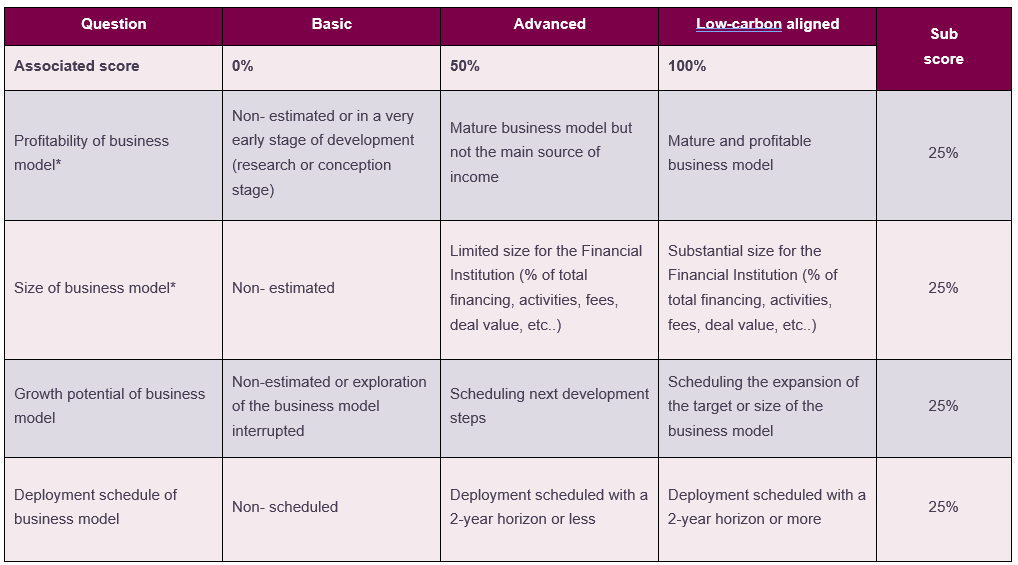

5.3.9.1 LEN 9.1 Tools/policy facilitating channelling credits to the transition towards a low carbon economy

| Description & Requirements | LEN 9.1 Tools/policy facilitating channelling credits to the transition towards a low carbon economy |

|---|---|

| Short description of indicator | The financial institution is actively developing internal tools and implementing policy enabling to foster low carbon economy financing. It is demonstrating the application of tools & policies through its portfolio mix composition, its loan granting process, or capital market services. The innovative tools are used in key strategic sectors (high emissive or green) and make it possible for the financial institution to boost its contribution to low carbon economy financing. |

| Data requirement |

The relevant data for this indicator are:

CDP Questionnaire mapping to this indicator:

External sources of data may also be used for the analysis of this indicator. |

| How the assessment will be done |

The analysis is based on the financial institution tools or policies degree of integration in its business activities. The analyst must assess the operational levers put in place to better support activities and companies in their transition. The analysis is based on (up to) five tool or policy categories proposed by the financial institution. The analyst evaluates the business model shift through a maturity matrix. If several tools or policies are accountable to this section, the final score will be the one given to the most mature activity (usually the one that is best scored too). The financial institution should not be penalized if it has built a mature business model and explores besides other tracks (which would be scored with a lower score) compared to another financial institution having only one mature business model. Relevant activity areas for this indicator include:

* Example: a 12% of Total revenue from green loans gives a 50% score for Profitability of financing activity which means ‘Mature business activity but not the main source of income or in a development stage (e.g. test)’

|

| Rationale | LEN 9.1 Tools/policy facilitating channelling credits to the transition towards a low carbon economy |

| Rationale of the indicator | The financial institution is developing tools and implementing policies that can help modify and drive their financings in favour of a low carbon economy. All financial institutions are guided by the balance between yield & risk. Enhancing policy or tool that can influence one of these two categories can be a game changer. All banks should for instance integrate climate risks into the credit risk analysis, and, as a result, score, whether before granting the loan, but also when conducting the credit risk analysis review during the loan period. Banks should set internal tools, inspired by existing best practices or anticipate future regulation (e.g. current discussion of the revision of the Capital Requirements Directive (CRD) (40)) in order to update their approach in the context of climate change contribution needs and related risks (popularized for almost a decade now (41) now and even spotted before (e.g. Andrew Dugolecki in 2005). |

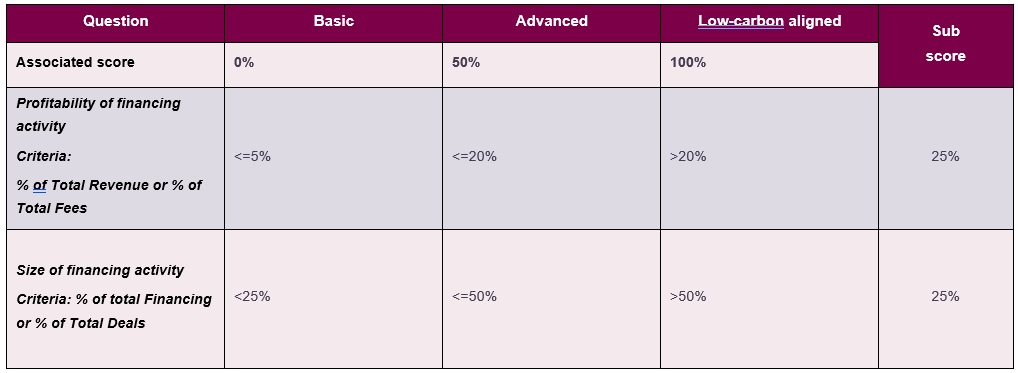

5.3.9.2 LEN 9.2 Financial flows reorientation towards (i) aligned or (ii) transitional entities or activities or (iii) climate change solutions

| Description & Requirements | LEN 9.2 Financial flows reorientation towards (i) aligned or (ii) transitional entities or activities or (iii) climate change solutions |

|---|---|

| Short description of indicator |

This indicator measures the financial institution contribution through the share of its financings towards (i) aligned or (ii) transitional entities or activities or (iii) climate change solutions versus the total outstanding loan amount. The goal is to capture the share of low-carbon activities/companies financed and its growth potential. Low-carbon activities or associated financial products are defined according to the EU Green taxonomy. |

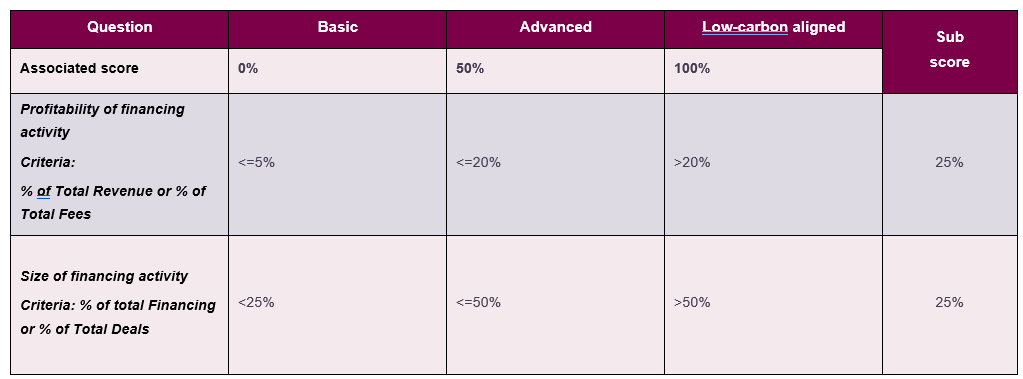

| How the assessment will be done |

Best practice elements to be identified in the test/analysis include:

CDP Questionnaire mapping to this indicator:

The analysis is based on (up to) five financing activities towards (i) aligned entities or activities, (ii) transitional or (iii) climate change solutions proposed by the financial institution. The analyst evaluates the business activities shift through a maturity matrix. If several financing activities for transition are accountable to this section, the final score will be the one given to the most mature financing activity (usually the one that is best scored too). The financial institution should not be penalized if it has built a mature business model and explores besides other tracks (which would be scored with a lower score) compared to another company having only one mature business model. Best practice elements to be identified in the test/analysis include:

* To score the ‘Profitability of financing activity’ and ‘Size of financing activity’ categories, the analyst shall refer to the following matrix: |

| Rationale |

Example: a 12% of Total revenue from green loans gives a 50% score for Profitability of financing activity which means ‘Mature business activity but not the main source of income or in a development stage (e.g. test)’

|

| Rationale of the indicator |

This indicator is for financial institution financing emissive activities or companies (e.g. companies operating on emissive value chain, upstream of an intensive activity, supplying part of the final product (e.g. transport equipment manufacturer)). A financial institution that finances part of a highly emitting final product bears some responsibility for the emissions linked to this product but is also at risk in a low carbon world. This indicator aims to capture the evolution of a financial institution's loan mix towards low-carbon activities and companies. For example, a bank granting a loan to a company that produces equipment for the automotive sector can help increase its share of products for electric vehicles, thus contributing to the promotion of low-carbon vehicles and reducing its risk linked to thermal vehicles in a low-carbon world. There is still a huge gap of financing in climate solutions and financial institution have the power to bridge part of this gap (along with other actors). Banks must align their business practices with Paris Agreement mitigation goal and contribute reducing GHG emissions in the real economy. |

6 Assessment

6.1 Sectoral Benchmarks

6.1.1 Description of the benchmarks

The fundamental target to achieve for all organizations is to contribute to not exceeding a threshold of 2⁰C global warming compared to pre-industrial temperatures. This target has long been widely accepted as a credible threshold for achieving a reasonable likelihood of avoiding climate instability, while a 1.5⁰C rise has been agreed upon as an aspirational target.

Therefore, low carbon scenarios used for the benchmarks are Well Below 2°C scenarios or 1.5°C scenarios.

Every financial institution sectoral financed emission shall be benchmarked according to an acceptable and credible benchmark that aligns with spatial boundary of the methodologies.

6.1.2 Mechanisms to compute the sectoral financial institution benchmark

The sectoral financial institution benchmark is the financial institution sectoral allocated decarbonization pathway. The financial institution is allocated this pathway from the sector decarbonization pathway, of which there are different pathways for different countries and regions. The extent to which a financed company is tied to a scenario in any one country is proportional to its sales in that country, thus the financial institution sectoral benchmark is geographically weighted.

Two types of benchmarks will be used depending on the type of sectors.

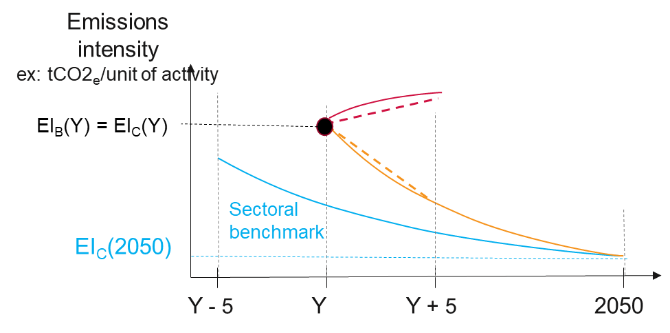

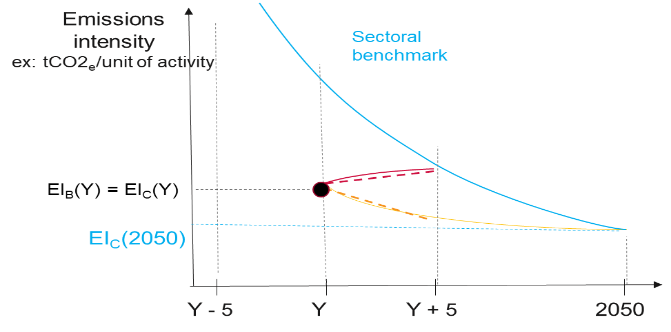

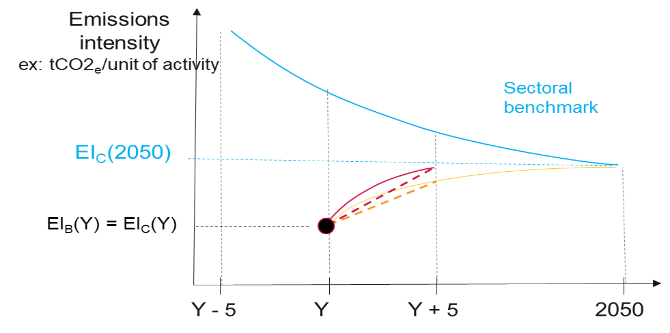

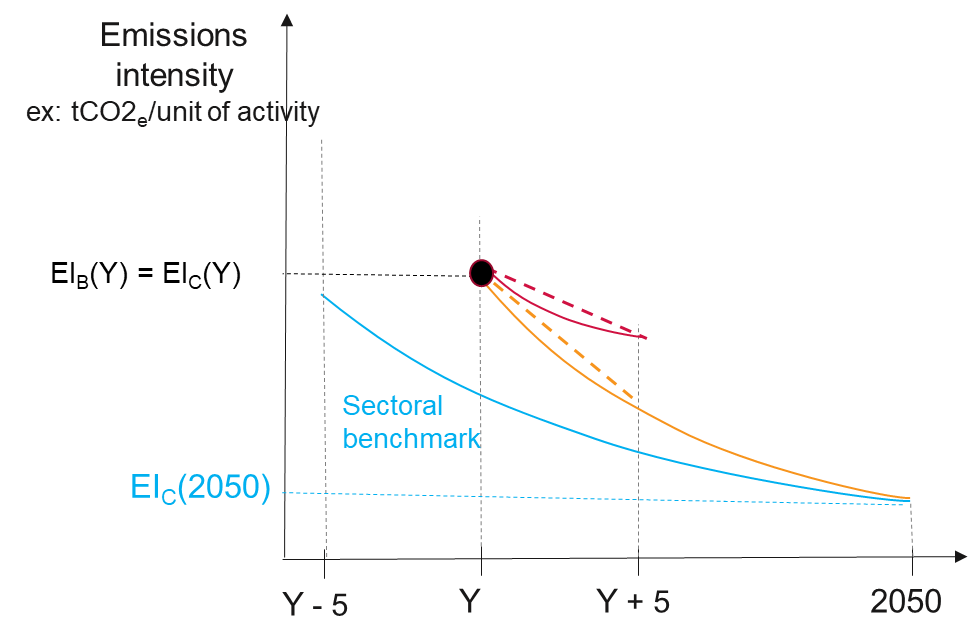

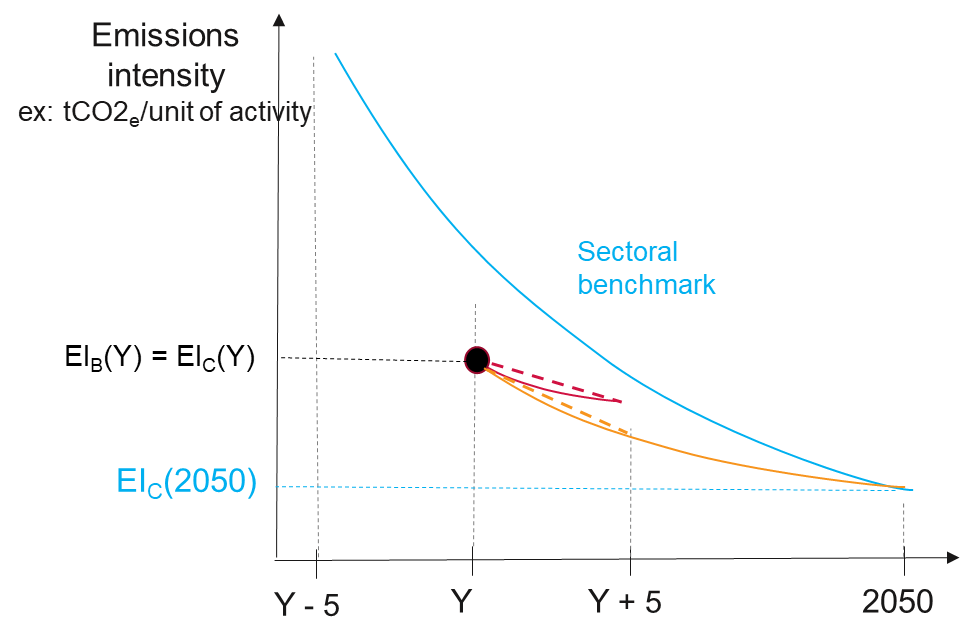

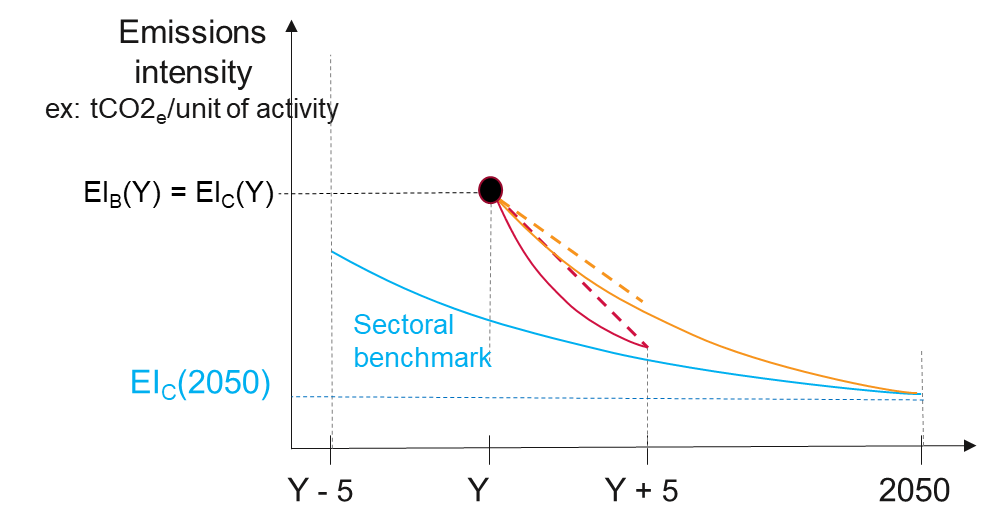

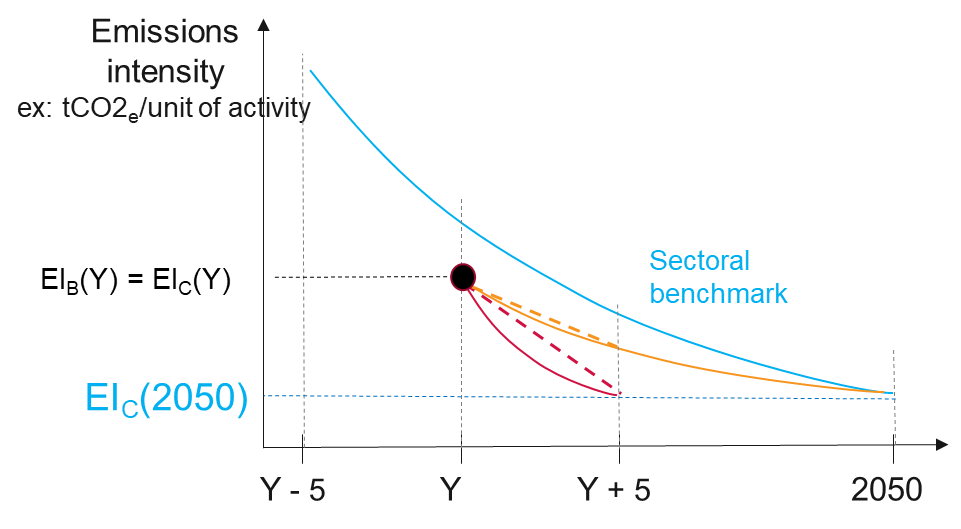

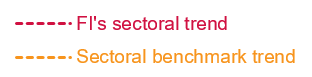

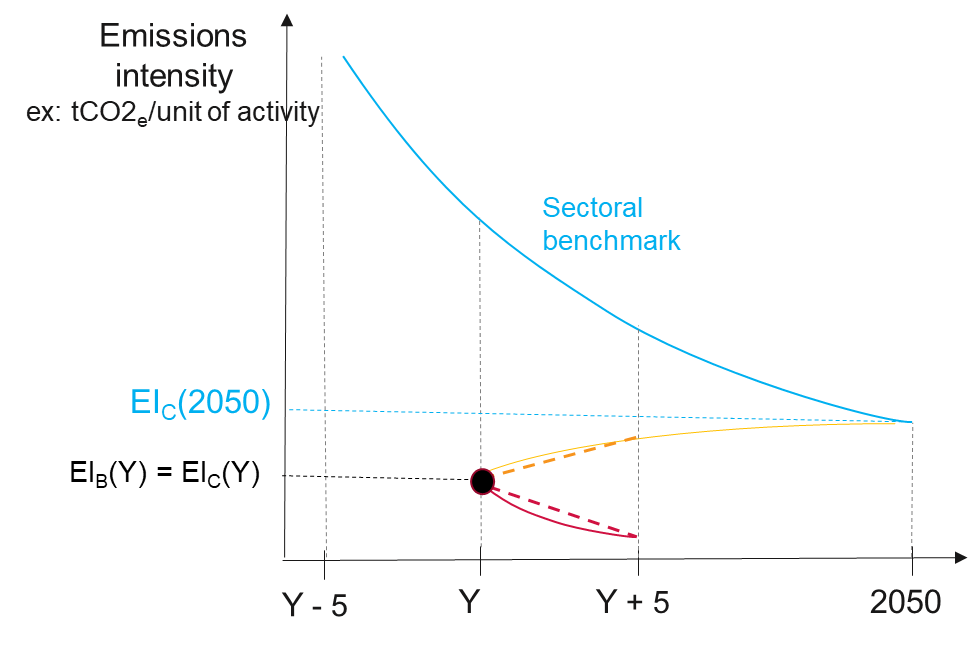

The first type of benchmark is a convergence approach for homogeneous sectors (e.g. cement, electric utilities). The allocation mechanism is taken from the sectoral decarbonization approach (SDA (11)) to science-based targets.

The allocation mechanism, as defined by the SDA (see Glossary), is the convergence mechanism. This allocation takes the financial institution’s sectoral financed intensity emissions in the base year and converges it to the related sector’s emissions intensity in 2050. Thus, sectoral financed emissions starting from a lower intensity will have a shallower decarbonisation pathway than sectoral financed emissions starting from a higher intensity. In this way, past action or in-action to reduce intensity is incorporated.

The second type of benchmark is the absolute contraction method from SBTi. It is used for heterogeneous sectors (Agri & Agro, Chemicals).

Benchmarks to be updated with an IEA NZE benchmark where possible by March 2023 (before road-testing). This table and the associated tool will be updated.

| Target type | Metric | Mechanisms |

|---|---|---|

| Agriculture & Agrifood (Sectoral financed emissions) | % of absolute emissions’ reduction | - SBT Absolute Contraction Approach (ACA) |

|

Scope 3.15 - Intensity Aluminium (Sectoral financed emissions) |

tCO2e/ton | - SBT Sectoral Decarbonization Approach (SDA) |

|

Scope 3.15 - Intensity Automotive (Sectoral financed emissions) |

gCO2e/p.km | - SBT SDA |

|

Scope 3.15 - Intensity Building (Sectoral financed emissions) |

kgCO2e/m2 | - SBT SDA |

|

Scope 3.15 - Intensity Cement (Sectoral financed emissions) |

tCO2e/ton | - SBT SDA |

|

Scope 3.15 - Absolute Chemicals (Sectoral financed emissions) |

% of absolute emissions’ reduction | - SBT ACA |

|

Scope 3.15 - Intensity Electric Utilities (Sectoral financed emissions) |

kgCO2e/kwh | - SBT SDA |

|

Scope 3.15 - Intensity Glass (Sectoral financed emissions) |

tCO2e/ton | - SBT SDA |

|

Scope 3.15 - Intensity Iron & Steel (Sectoral financed emissions) |

kgCO2e/ton | - SBT SDA |

|

Scope 3.15 - Intensity Oil & Gas (Sectoral financed emissions) |

tCO2e/TJ | - SBT SDA |

|

Scope 3.15 - Intensity Pulp & Paper (Sectoral) |

tCO2e/t | - SBT SDA |

|

Scope 3.15 - Intensity Real Estate (Sectoral financed emissions) |

kgCO2e/m2 | - SBT SDA |

|

Scope 3.15 - Intensity Transport (Sectoral financed emissions) |

gCO2e/p.km gCO2e/t/km |

- SBT SDA |

|

Scope 3.15 - Intensity Asset Class (Sectoral financed emissions) |

- Intensity metric related to the sector the asset class is tied (see above) | - SBT SDA |

|

Scope 3.15 - Absolute Asset Class (Asset class financed emissions) |

% of absolute emissions’ reduction | - SBT ACA |

|

Scope 3.15 - Absolute General (Global Financed emissions) |

% of absolute emissions’ reduction | - SBT ACA |

6.1.3 Reference pathways classification

A reference pathway defines the carbon intensity (tCO2/activity) pathway for homogeneous sectors or the carbon absolute emissions (tCO2) trajectory for heterogeneous sectors (e.g. Chemicals).

In order to allocate decarbonization pathway to the financial institution, two options were decided with the technical working group:

- Use the Sectoral Decarbonization Approach (SDA) of the Science Based Target initiative (SBTi) (42) when targets are tied to sectors (and when applicable to the sectors (i.e. homogenous sectors such as Cement, Real Estate, Electric Utilities)).

- Use an existing generic method such as the Absolute Contraction Approach (ACA) of the Science Based Target initiative (SBTi) for targets not referring to a sector (absolute asset class targets) and/or being global (absolute portfolio targets).

6.1.4 Available reference pathways

| Target type | Metric | Benchmarks (4) |

|---|---|---|

| Agriculture & Agrifood (Sectoral financed emissions) | % of absolute emissions’ reduction | - 1.5°C IEA Scenario |

|

Scope 3.15 - Intensity Aluminium (Sectoral financed emissions) |

tCO2e/ton | - IEA ETP 2020 - SDS |

|

Scope 3.15 - Intensity Automotive (Sectoral financed emissions) |

gCO2e/p.km | - IEA ETP 2017 - B2DS |

|

Scope 3.15 - Intensity Building (Sectoral financed emissions) |

kgCO2e/m2 | - IEA ETP 2017 - B2DS |

|

Scope 3.15 - Intensity Cement (Sectoral financed emissions) |

tCO2e/ton | - IEA 2017 B2DS |

|

Scope 3.15 - Absolute Chemicals (Sectoral financed emissions) |

% of absolute emissions’ reduction | - 1.5°C IEA scenario |

|

Scope 3.15 - Intensity Electric Utilities (Sectoral financed emissions) |

kgCO2e/kwh |

- SBT SDA - IEA ETP 2017 – B2DS |

|

Scope 3.15 - Intensity Glass (Sectoral financed emissions) |

tCO2e/ton | - IEA ETP 2020 - SDS |

|

Scope 3.15 - Intensity Iron & Steel (Sectoral financed emissions) |

kgCO2e/ton | - IEA ETP 2020 - SDS |

|

Scope 3.15 - Intensity Oil & Gas (Sectoral financed emissions) |

tCO2e/TJ | - IEA NZE 2021 |

|

Scope 3.15 - Intensity Pulp & Paper (Sectoral) |

tCO2e/t | - IEA ETP 2020 - SDS |

|

Scope 3.15 - Intensity Real Estate (Sectoral financed emissions) |

kgCO2e/m2 | - IEA ETP 2017 B2DS |

|

Scope 3.15 - Intensity Transport (Sectoral financed emissions) |

gCO2e/p.km gCO2e/t/km |

- IEA ETP 2017 B2DS |

|

Scope 3.15 - Intensity Asset Class (Sectoral financed emissions) |

- Intensity metric related to the sector the asset class is tied5 | - 1.5°C IEA scenario |

|

Scope 3.15 - Absolute Asset Class (Asset class financed emissions) |

% of absolute emissions’ reduction | - 1.5°C IEA scenario |

|

Scope 3.15 - Absolute General (Global Financed emissions) |

% of absolute emissions’ reduction | - 1.5°C IEA scenario |

Benchmarks to be updated with an IEA NZE benchmark where possible by March 2023 (before road-testing). This table and the associated tool will be updated.

The scenarios used in the tool are coming from the IEA. Still, one can use other scenarios if preferred (for instance OECM (43)). The scenarios used here come from the IEA ETP of 2017, 2020 or NZE 2021.

IMPORTANT: scenarios referenced in the table above have not been updated with the most recent scientific scenarios available on all sectors for methodological reasons. An update of the mentioned scenarios will be done before the road-test where relevant. Problem with NZE benchmark is the low geographical granularity on some sectors while it is known that decarbonization efforts will be different between developed countries (higher decarbonization rate) than EMDE ones (lower decarbonization rate).

If the ACT Team chooses not to update the tool with all IEA NZE benchmarks for sectoral reason, It will not be a problem at the financial institution level as the non-harmonization of scenarios are at the advantage of the financial institution since scenarios dating back 2017 or 2020 do not take into account the carbon budget that have already been consumed until today. Basically, if the commitment gap of the financial institution on these sectors is high, it will mean that the financial institution sectoral targets are very far from where it should be as most recent scenarios are even more demanding in terms of carbon GHG emission reduction. The challenge would be about the comparison between financial institutions as it will be possible in 2023 to benchmark financial institutions among the road-test sample. Reason is that financial institution exposed to certain sectors could be advantaged or penalized given the date and ambition of the benchmark (e.g. ETP 2017 vs NZE 2021).

In sum, please keep in mind that background scenarios will be updated.

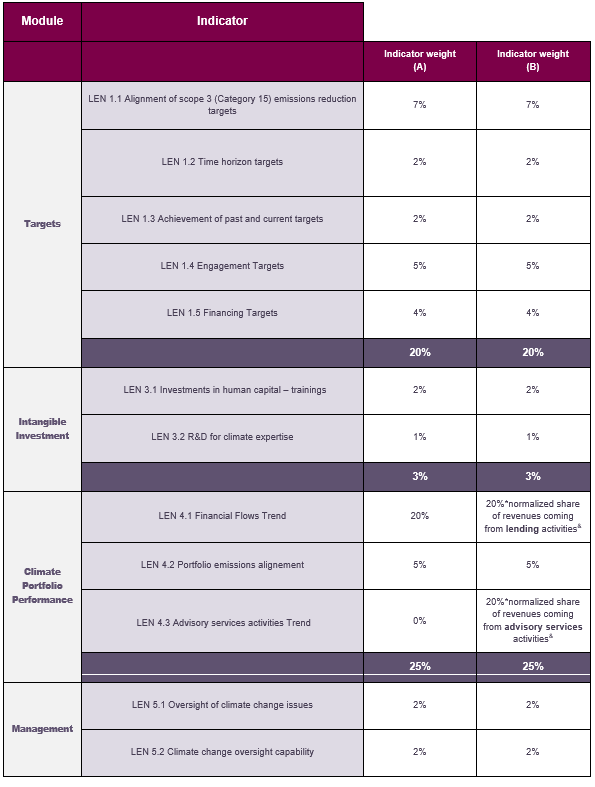

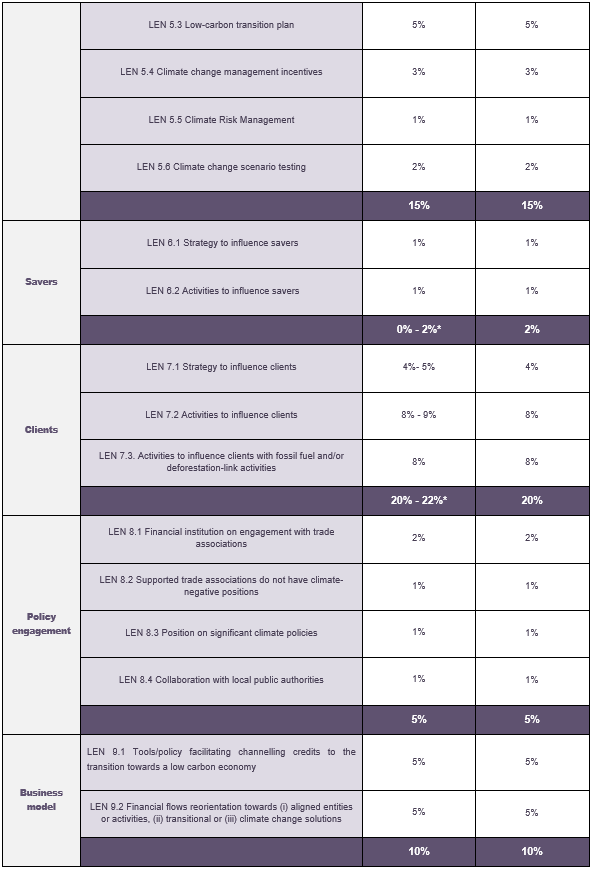

6.2 Weightings

A. Commercial and Retail banks (lending activities to corporates and/or consumers)

B. Commercial and Retails banks (idem) + capital market activities (equity and bonds underwriting)

* weighting variation depending on the existence of saving deposits (2%) or not (0%). If there is no saving deposit then these 2% have been allocated to the module 7. Clients engagement (1% for 7.1 and 1% for 7.2).

& the sum of normalized share of revenues coming from lending and advisory services activities is of 100%, thus global sum of the weights of the module is always equal to 25%.

As an example, if global revenues is 110, including 80 for lending, 20 for advisory services and 10 others, normalized shares of lending and advisory services will be respectively of 80% and 20%. The weight attributed to LEN 4.1 will be 20%*80%=16% and to LEN 4.3 20%*20% = 4%.

Rationale for weightings

The selection of weights for both the modules and the individual indicators was guided by a set of principles (see the ACT framework document for more information). These principles helped define the weighting scheme of the modules and indicators.

| Principle | Explanation |

|---|---|

| Value of information | The value of the information that an indicator gives about a financial institution’s outlook for the low-carbon transition is the primary principle for the selection of the weights. |

| Impact of variation | A high impact of variation in an indicator means that not performing in such an indicator has a large impact on the success of a low-carbon transition, and this makes it more relevant for the assessment. |

| Future orientation | Indicators that measure the future, or a proxy for the future, are more relevant for the ACT assessment than past & present indicators, which serve only to inform about the likelihood and credibility of the transition. |

| Data quality sensitivity | Indicators that are highly sensitive to expected data quality variations are not recommended for a high weight compared to other indicators, unless there is no other way to measure a particular dimension of the transition. |

The weightings have been designed for two types of financial institutions covered in this ACT 4 Finance methodology in order to reflect the strategic stakes which are different from a bank to another.

Targets 20%

Represents an important part of the performance score as it counts for 20%. Target-setting is the first key step in the journey to Net Zero. It is a key milestone in the climate strategy of a financial institution as it gives the path to follow regarding the companies and sectors to finance in their decarbonization journey.

We assess:

GHG emissions targets. We will assess the commitment gap of the Financial Institution between their objectives and sectoral/global science-based scenarios (IEA ETP 2017 (to be updated by NZ IEA 2050) or OECM pathways). We will use the SDA/ACA target setting method in the different categories (Global, Sectoral and/or Asset class). The latter do not have the same weightings as we want to reward sectoral and asset class target setting approaches (please refer to the module ‘Scoring’ to have an overview of the weighting breakdown). The module also contains metrics that assess the current degree of completion of the targets set. Thus, it provides a great picture of the current financial institution performance on its financed emissions reduction. As this methodology is looking to assess contribution, it not a sufficient robust approach to assess the climate performance of a financial institution: portfolio can decarbonize by reallocation while not leading to GHG reduction in the real economy. This why this it includes non-GHG based targets on fossil fuels sectors, deforestation, companies with a transition and climate solution financing (as there is still a huge financing gap to bridge).

Non GHG emissions targets. Assessing the engagement & financing targets in order to capture the objectives of the financial institution in terms of contribution to the transition (the present performance on these topics will also be assessed in either Climate performance module (#4), Investees engagement (#7) and/or Business model (#9)). We have been including the engagement targets on Oil & Gas and Coal as we consider it to be a first/priority approach as a credible net-zero aligned strategy. Capturing sectoral targets on Fossil Fuels and deforestation are quite an innovative update as it was not existing in the previous methodologies. As mentioned in the document, it is not possible to have a robust and credible transition plan without an explicit, transparent and scientific aligned targets (i.e. exit and exclusion strategy) on these sectors.

These non GHG emission-based targets are qualitative, meaning that we have created categories of best practices level based on scientific recommendations.

Material Investment 0%

This module assesses the current and projected emissions associated with scope 1 and scope 2 emissions. This is the reason why it is not a relevant module for this methodology. The emissions associated with the financings are much higher and key for this sector. The ACT methodology follow the recommendations of the ISO 14064-1 in terms of boundary applicable to GHG reporting: all direct and indirect significant emissions must be reported. Emissions from scope 1 and scope 2 do not represent significant emissions of a financial institution (7).

Intangible Investment 3%

Banks must raise their climate capabilities, both for better understanding the climate risk and financial flows reorientation and being able to support companies on how to best transition, in order for banks’ lending portfolio to meet their commitments.

Better structuring loans with climate consideration demands a specific knowledge that need to be acquired.

The weight is quite low notably because these intangible investments in human capital are quite difficult to quantify and evaluate.

Portfolio Climate Performance 25%

This module represents 25% of the assessment as it the core performance module of the tool.

Our approach in this ‘Climate Performance Module’ is that we are not assessing the GHG emissions of the Financial Institution tied to its counterparties/activities financed. What we want to measure is the contribution of the financial institution to financing the decarbonization of the economy. Currently, a 1.5°C aligned portfolio has a low real economy impact: it means that it finances pure-players/climate best in class companies and/or taxonomic activities while the main challenge is to finance the transition of high emitting sectors’ companies. Conversely, a portfolio with high financed emissions but proving to help high emitting sectors decarbonize has more impact in GHG emission in the real economy.

As so, we assess whether the financial institution is financing (i) companies with a transition plan or not (for General corporate purpose instruments) and (ii) enabling/transitional/aligned activities or not (for Use of Proceeds instruments). We capture the evolution of these financing amounts (by sector) from ‘Reporting Year’ minus 3 years.(Indicator 4.1)

This indicator is completed by a maturity matrix. Given the heterogeneity in terms of portfolio alignment metrics and outputs, it has been out of reach to draft a unique way of assessing the portfolio alignment of a financial institution. Relevant tools exist today but always have bias preventing from benchmarking financial institution’s portfolio alignment from another. It aims to capture the relevancy of the portfolio alignment exercise done by the Financial Institution. This exercise must be conducted in order to identify the companies to engage with. Basically, this exercise should lead to an engagement action plan. This is what we assess in this second indicator (4.2), notably through different categories: Desired outcomes of the exercise, Disclosure & Transparency, Metrics usefulness (among other).

Our approach is more impact driven (flow & engagement) than transition risk driven (pure GHG emissions focus).

Management 15%

Management is a multi-faceted module that makes up 15% of the score, because it incorporates many different smaller indicators that together paint a picture of the financial institution’s management and strategic approach to the low-carbon transition. Some weight is placed on the oversight of climate change issues and the climate change oversight capability, which are weighted 2%. These two indicators measure the ability of the financial institution to integrate sustainability to its strategy and to embrace the main challenges related to low-carbon transition. Besides, according to the principle of future orientation, the transition plan provides more information on how this company will specifically deal with the transition, and has a weight of 5%.

The remaining indicators (climate change management incentives, Climate Risk Management and climate change scenario testing) have a weight of 3%, 1% and 2% as they can either strengthen or undermine the financial institution’s ability to carry out the transition plan and meet ambitious science-based targets. Given the specificity of the finance actor, the Climate change management incentives have been updated to 3% as if all front office employees have a direct remuneration with climate deals, it demonstrates the operational declination of the climate strategy.

Savers engagement 0 - 2%

To decarbonize the whole economy, it is essential that all stakeholders get involved. Deposits are a key financial resource for many credit institutions. The deposit relationship, whether with a corporate or a retail (consumer) saver, is often one entry point for the institution in order to provide other product and services. Given the proximity of some retail banks with corporates and/or consumers, a real dialogue on climate and transition can happen and trigger changes. Depending on the size of deposits compared to the balance sheet of the financial institution, the module will apply or not. In the latter case, the associated weighting (2%) is repercussed to the following module.

Clients engagement 20%-22%

This module represents 20% (22% if the Saver’s engagement module does not apply, see above) as engagement with counterparties is essential for boosting GHG emissions reduction in the real economy. After having reoriented part of its financial flows (module 4) the financial institution must also take actions with the counterparties it finances in order to help them decarbonize. As a money provider, it has important responsibility for the consequence of the GHG emissions it unlocked. Various levers exist. The idea is to assess the robustness of the engagement framework and to understand whether the engagement strategy is tied to an impact management system standardize or if it follows in internal theory of change, leading to the possibility of defining by its own what is impactful or not.

Policy engagement 5%

In line with the rationale for the management indicators of low weight, the policy engagement indicators are also contextual aspects which tell a narrative about the financial institution’s stance on climate change and how the financial institution expresses their engagement with policy makers and trade associations.

Business model 10%

The module captures many elements and aspects that cannot otherwise be captured in any of the other modules. It includes those aspects that are important to trigger a change in the business activities of a financial institution. It is future oriented by asking the financial institution on its narrative on certain future directions it can/has to take to enable the transition.

6.3 Data request

Table 1Table 18 introduces the list of information that will be requested to financial institutions through a questionnaire, as well as the corresponding indicators.

| Module | Indicators | Data request |

|---|---|---|

| 1 - Targets | 1.1 | Emissions (in absolute or physical intensity) at reporting year, at year the target was set, its reduction target, the credit exposure, the target credit exposure, the target GHG coverage, and other information if necessary (geography, …) |

| Reduction targets in sectoral intensity approach | ||

| 1.2 | A comparison of: (a) the longest time horizon of the financial institution sectoral targets, and (b) the long-term point fixed by ACT assessment methodology. | |

| The financial institution has interval (<=5years) targets that ensure both short and long-term targets are in place to incentivize short-term action and communicate long-term commitments. | ||

| 1.3 | Base year | |

| Reporting year | ||

| Target year | ||

| Percentage of reduction target from base year in absolute emissions | ||

| Percentage of reduction target achieved in absolute emissions | ||

| Percentage of reduction target from base year in emissions intensity | ||

| Percentage of reduction target achieved in absolute emissions intensity | ||

| 1.4. | Coal and Oil & Gas Exit policy. Phase-out date, exclusion scope. | |

| Deforestation financing exclusion policy. Phase-out date, exclusion scope | ||

| Portfolio coverage target year, Scope/Portfolio coverage target on transition plan. | ||

| 1.5. | Climate financing roadmap/framework | |

| 3 - Intangible investment | 3.1 | Total number of employees, Number of employees receiving climate-related trainings, Total costs of employees’ trainings, costs of climate-related trainings. |

| Pedagogical/climate training capabilities roadmap. | ||

| 3.2 | R&D Budget and budget dedicated to climate topics | |

| 4 - Portfolio Climate Performance | 4.1 |

Use of Proceeds amounts. Taxonomic activities financed. Breakdown by sector and asset class. General Corporate Purpose amounts. Financed Companies with a credible and robust transition plan. |

| 4.2 | Portfolio alignment exercise outputs | |

| 4.3 |

Use of Proceeds amounts. Taxonomic activities advised. Breakdown by sector and asset class. General Corporate Purpose amounts. Advised companies with a credible and robust transition plan. |

|

| 5 - Management | 5.1 | Environmental policy and details regarding governance |

| 5.2 | Environmental policy and details regarding governance | |

| 5.3 | Environmental policy and details regarding governance | |

| 5.4 | Management incentives | |

| 5.5 | Climate risk management framework/strategy | |

| 5.6 | Scenario testing | |

| 6 - Savers engagement | 6.1 | Engagement strategy and measures of success |

| 6.2 |

Actions implemented to influence savers to reduce their GHG emissions Size and Number of savers engaged |

|

| 7 - Clients engagement | 7.1 | Engagement strategy to influence clients GHG emissions |

| Impact Management framework | ||

| Fossil Fuel & Deforestation engagement strategy | ||

| 7.2 | Strategy to influence clients GHG emissions | |

| Size and number of clients engaged | ||

| 7.3 | Fossil Fuel & Deforestation engagement actions implemented | |

| 8- Policy engagement | 8.1 | Public climate change policy positions |

| Description of this policy (scope & boundaries, responsibilities, process to monitor and review) | ||

| Trade associations that are likely to take a position on climate change legislation | ||

| 8.2 | Company policy on engagement with associations, alliances, coalitions or thinktanks | |

| 8.3 | Position of the company on significant climate policies (public statements, etc.). | |

| 8.4 | Public climate change policy positions | |

| Description of this policy (scope & boundaries, responsibilities, process to monitor and review) | ||

| 9 - Business Model | 9.1 | Description of the tools and policies implemented to change the structural financing approach and other ways of appraising economic value. |

| Size of implementation. Deployment schedule. Growth potential. Profitability. | ||

| 9.2 | Amount of Low carbon share of financings | |

| Profitability of business model | ||

| Size of business model | ||

| Growth potential of business model | ||

| Deployment schedule of business model |

7 Rating